| |

Yield-Accretive Acquisition of Plaza Singapura: The acquisition of Plaza Singapura in 2004 was an important step in allowing CMT to continue to deliver improved returns and growth for investors, as it offers yield accretion, competitive strengths, diversification, growth potential and improved liquidity. With the addition of Plaza Singapura, acquired at a price of S$710.01 million, CMT has reduced the total net property income derived from any one property to no more than 30.2 percent, down from 34.7 percent for the same period (from 2 August to 31 December 2004) if Plaza Singapura had not been acquired. Portfolio size has also increased from S$1.4 billion (valuation of four existing properties as at 10 June 2004) prior to the acquisition of Plaza Singapura to S$2.1 billion after the acquisition. In addition, for 2004, annualised Distribution Per Unit (DPU) forecast was raised from 8.59 cents to an annualised 9.21 cents. CMT Portfolio: At the end of 2004, with the acquisition of Plaza Singapura and the completion of the various enhancement works at our malls, the five properties in our portfolio had a property valuation of S$2.2 billion, or 80.2 percent more than the valuation of

|

|

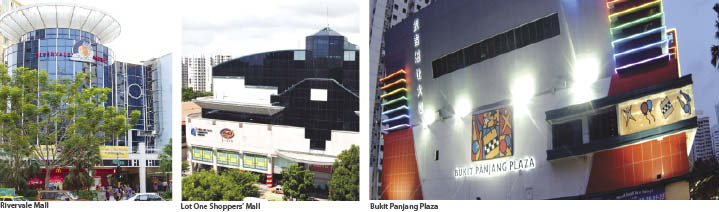

of our portfolio as at 31 December 2003. Excluding Plaza Singapura, the valuation of the four properties increased by 20.8 percent from approximately S$1.2 billion as at 31 December 2003 to approximately S$1.5 billion as at 31 December 2004. Investment in CapitaRetail Singapore Limited (CRS): CMT has a 27.2 percent (S$58.0 million) stake in CRS (a private fund sponsored by CapitaLand Limited) through its Class E bonds issued by CRS. The CRS portfolio consists of three properties, Lot One Shoppers’ Mall, Bukit Panjang Plaza and Rivervale Mall. The first targeted minimum coupon rate of 8.2 percent per annum was received by CMT in August 2004. Valuation of the three properties increased from S$488.7 million (as at 18 September 2003) in 2003 to S$540.0 million (as at 1 December 2004) in 2004 and CMT has the first right of refusal to purchase the properties.

|

|