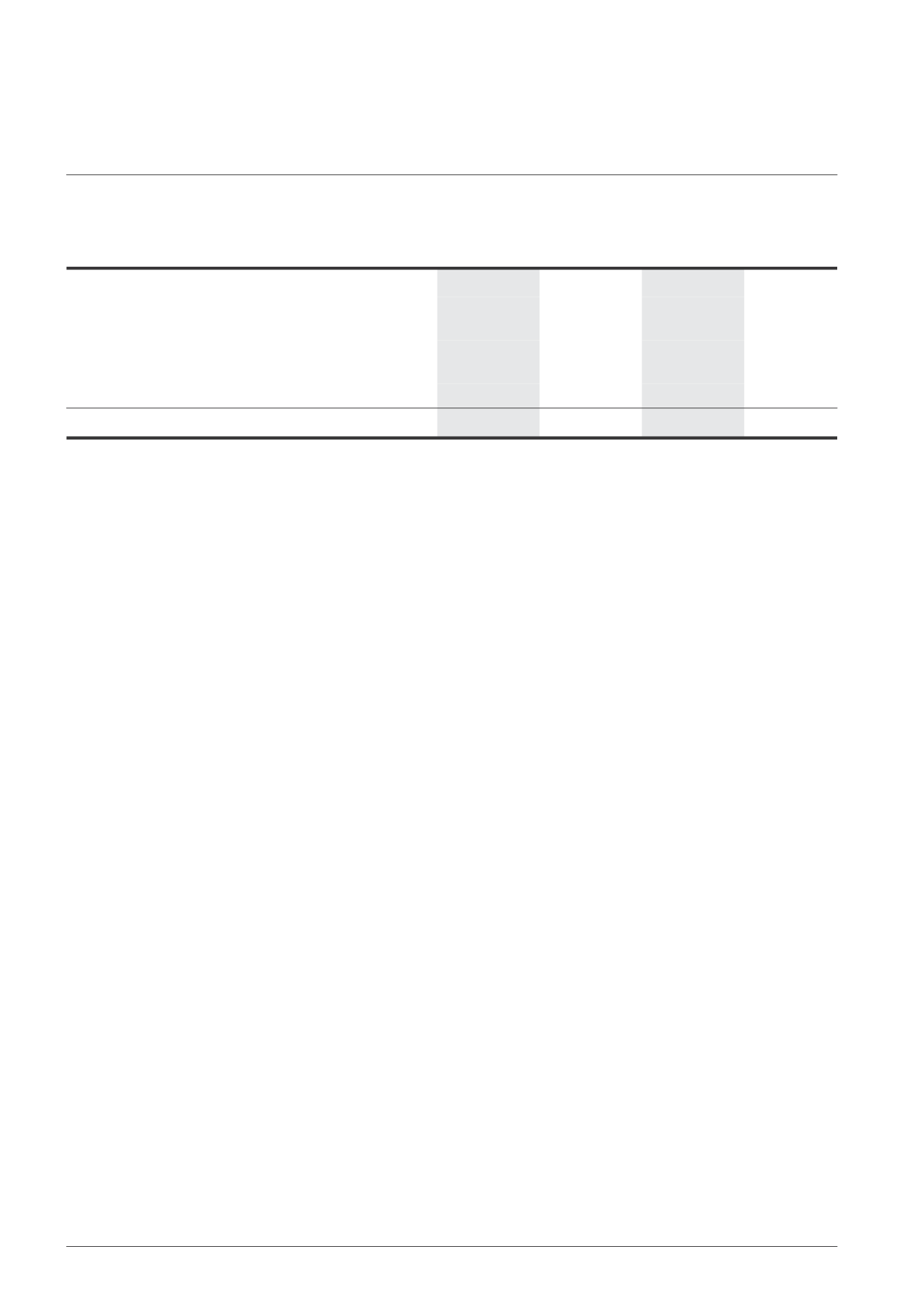

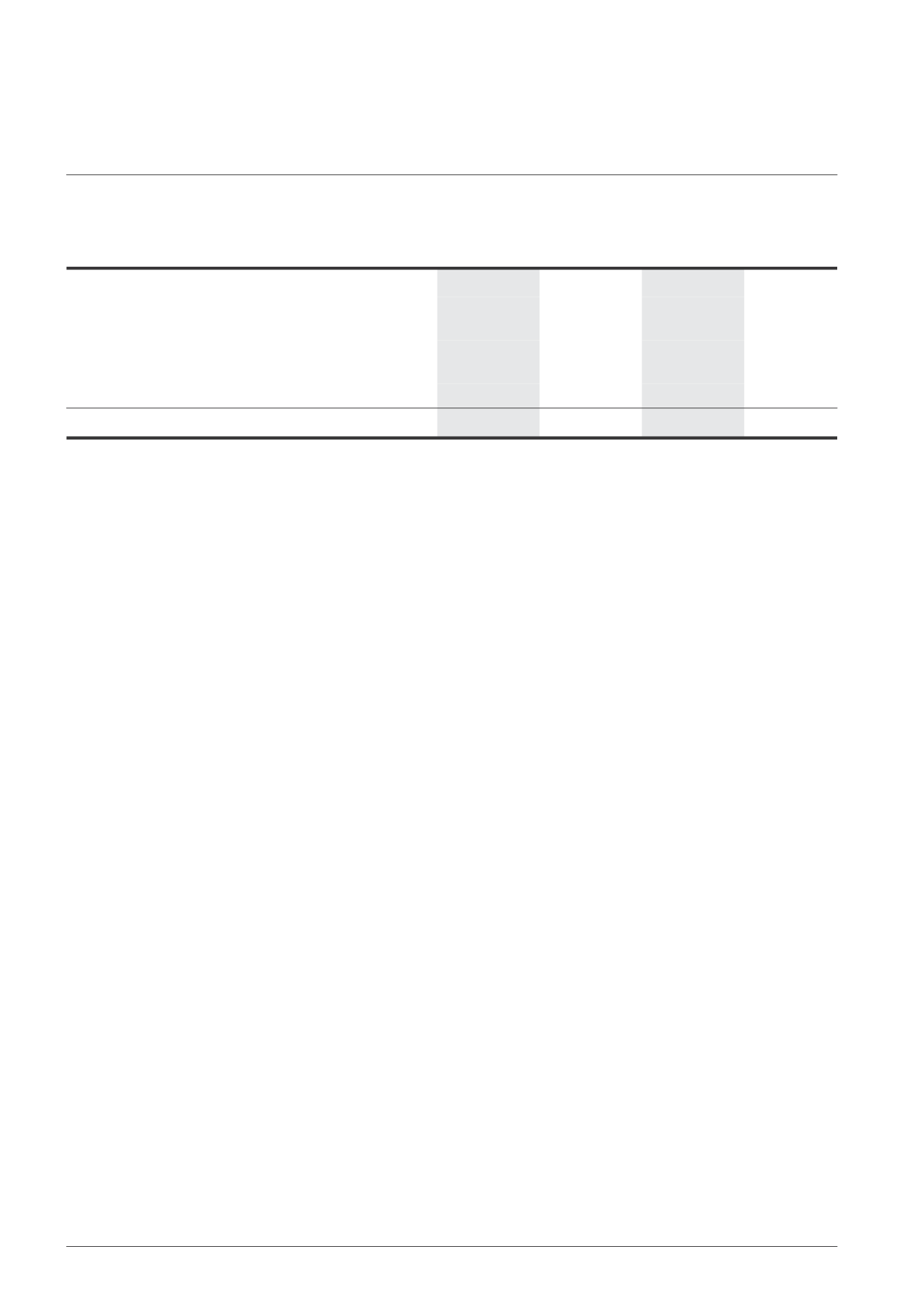

Note A – Net tax adjustments comprise:

Group

Trust

2014

2013

2014

2013

(Restated)

$’000

$’000

$’000

$’000

Non-tax deductible items:

– trustee’s fees

1,198

1,123

1,198

1,123

– non-deductible interest expenses

7,583

7,076

10,805

4,533

– other items

11,485

16,443

11,485

16,443

Tax deductible items:

– capital allowances/balancing allowances

(7,718)

(6,646)

(7,718)

(6,646)

Net tax adjustments

12,548

17,996

15,770

15,453

Note B

Amount relates to 9.31% premium paid on the remaining $98.25 million in principal amount of the

$650.0 million 1.0% Convertible Bonds due 2013 upon maturity on 2 July 2013. In deriving the

distributable income, the premium is eligible for tax deduction upon payment.

Note C

Amount retained for general corporate and working capital in financial year 2014 relates to the capital

distribution and tax-exempt income received from CapitaRetail China Trust (“CRCT”) of $11.4 million.

In addition, the Trust has received partial distribution of $30.0 million from Infinity Office Trust relating

to the profit arising from the sale of office strata units in Westgate Tower, of which $4.5 million has

been released as one-off other gain distribution while the balance of $25.5 million has been retained

for general corporate and working capital purposes.

For financial year 2013, this relates to the capital distribution and tax-exempt income received from

CRCT of $7.6 million and tax-exempt special preference dividend income from CapitaRetail

Singapore Limited of $3.5 million.

The accompanying notes form an integral part of these financial statements.

Distribution Statements

Year ended 31 December 2014

138 | CapitaMall Trust Annual Report 2014