2 BASIS OF PREPARATION

(continued)

2.5 Changes in accounting policies

(continued)

Joint Arrangements

(continued)

The Group has re-evaluated the rights and obligations of the parties to these joint

arrangements and has determined that the parties in these joint arrangements have rights

to the net assets of the joint arrangements. Accordingly, these joint arrangements have

been reclassified as joint ventures under FRS 111 and are accounted for using the equity

method. The quantitative impact of the change is as follows:

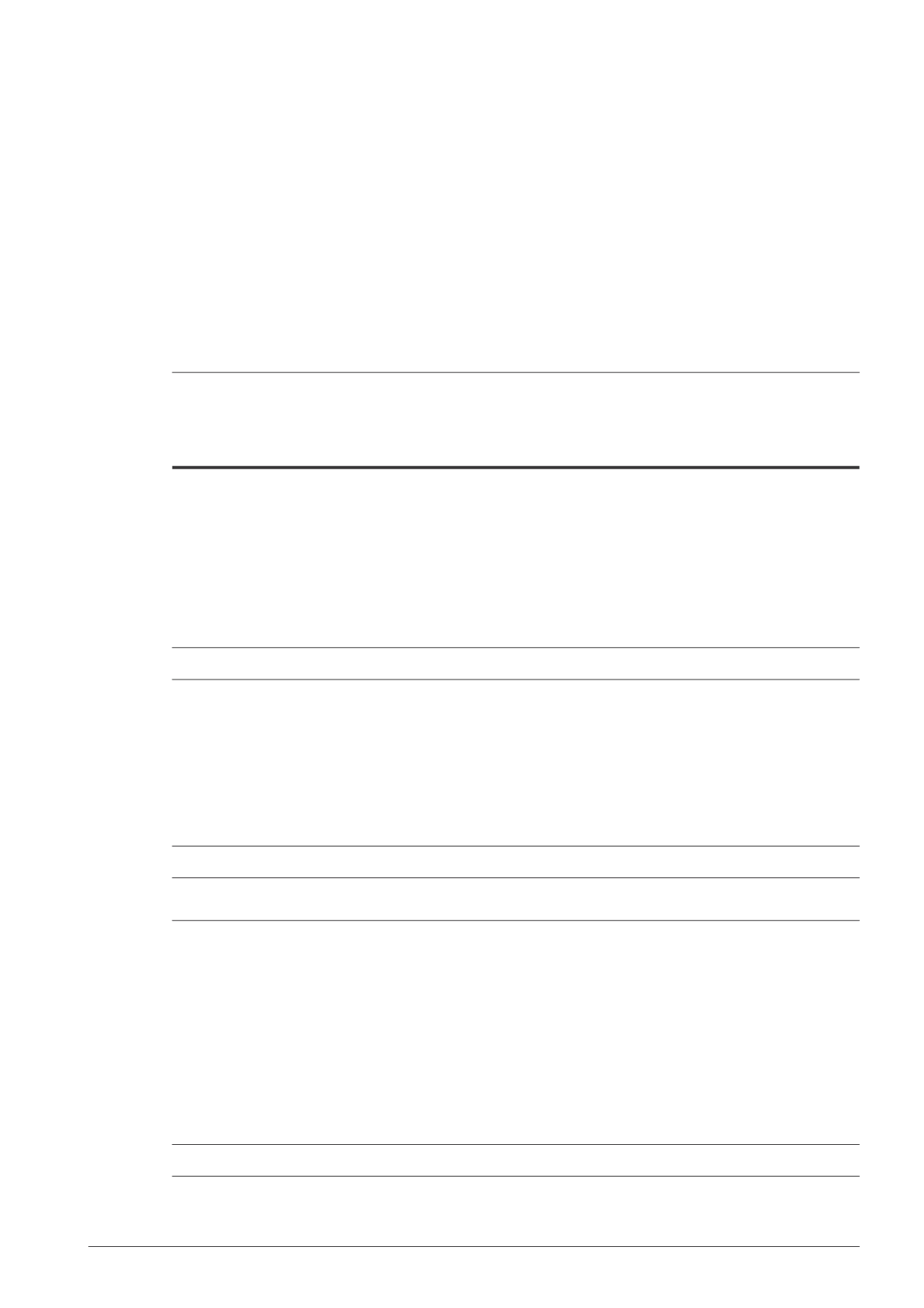

Impact on Statement of Financial Position – Group

As at 1 January 2013

As at 31 December 2013

As

previously

reported

Joint

arrangements

As

restated

As

previously

reported

Joint

arrangements

As

restated

$’000

$’000

$’000

$’000

$’000

$’000

Non-current assets

Plant and equipment

2,085

(83)

2,002

3,249

(1,039)

2,210

Investment properties 8,191,800 (1,160,800) 7,031,000 8,799,400 (1,523,400) 7,276,000

Investment properties

under development

336,027

(336,027)

–

–

–

–

Associate and joint

ventures

227,476

769,971 997,447 275,455

810,356 1,085,811

Financial derivative

–

–

–

4,530

–

4,530

8,757,388

(726,939) 8,030,449 9,082,634

(714,083) 8,368,551

Current assets

Inventories

218

(218)

–

244

(244)

–

Development property

for sale

–

–

–

91,106

(91,106)

–

Trade and other

receivables

12,845

8,223 21,068

10,828

10,718 21,546

Cash and cash

equivalents

1,118,270

(10,116) 1,108,154 832,687

(2,826)

829,861

1,131,333

(2,111) 1,129,222 934,865

(83,458)

851,407

Total assets

9,888,721

(729,050) 9,159,671 10,017,499

(797,541) 9,219,958

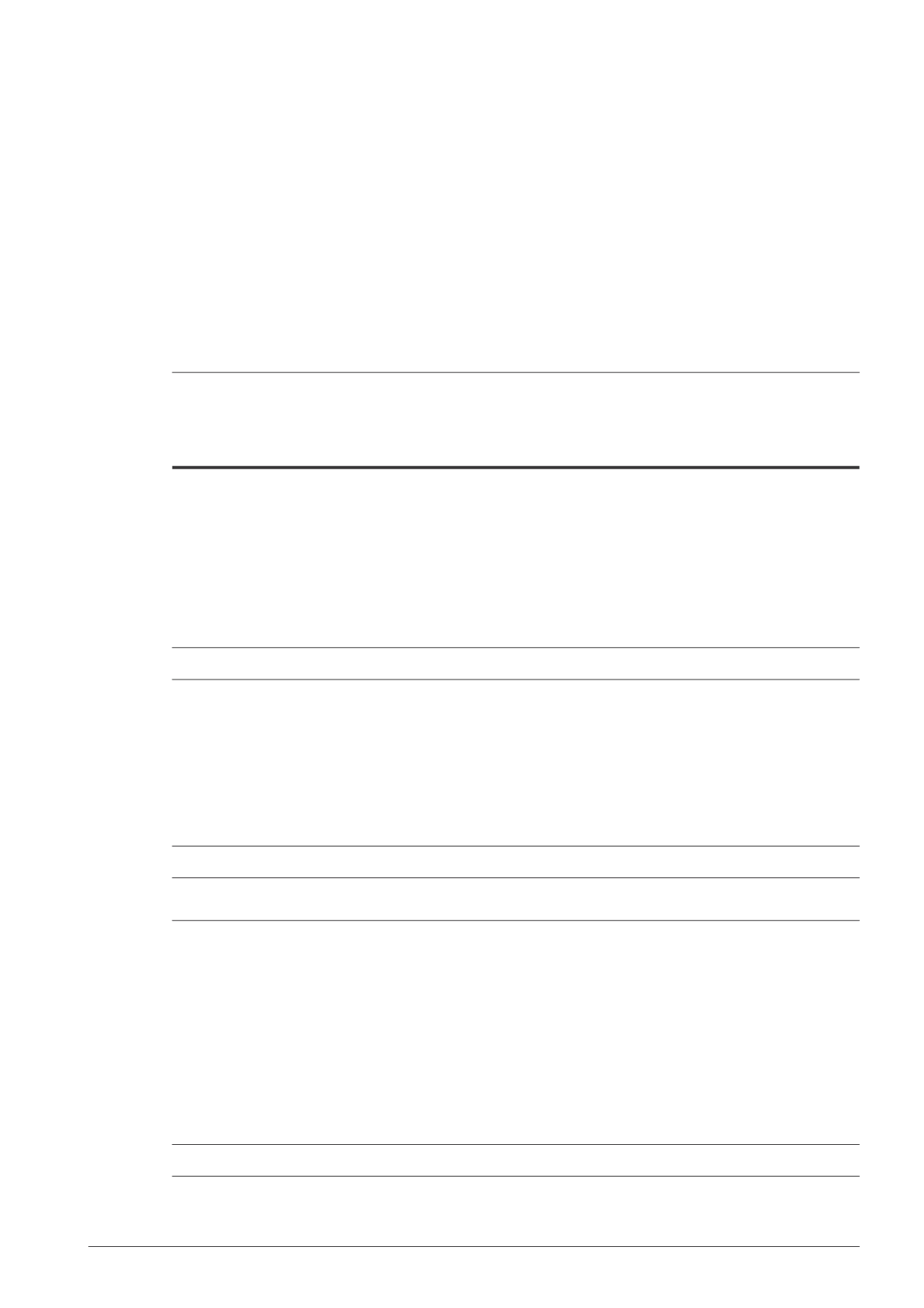

Current liabilities

Financial derivative

–

–

–

5,132

–

5,132

Trade and other

payables

235,135

(24,019)

211,116 169,973

(28,373)

141,600

Current portion of

security deposits

54,017

(5,638)

48,379

45,225

(4,107)

41,118

Interest-bearing

borrowings

300,000

– 300,000 150,000

– 150,000

Convertible bonds

105,188

– 105,188 348,349

– 348,349

Provision for taxation

45

–

45

494

–

494

694,385

(29,657)

664,728 719,173

(32,480)

686,693

Leading with Confidence | 151