YIELD ACCRETIVE ACQUISITIONS

On 1 June 2007, CMT acquired the balance 72.8% of the total Class E Bonds due 2009 issued by CapitaRetail Singapore Limited (CRS), a private property fund sponsored by CapitaLand Limited, and redeemable preference shares of S$0.10 each issued by CRS in connection with the Secured Fixed Rate Class E Bonds which were not held by CMT.

Together with the 27.2% interest in Class E Bonds which CMT held then, CMT is currently the sole owner of the Class E Bonds and effectively owns 100.0% of the beneficial interest in the property portfolio of CRS, which comprises three shopping centres in Singapore, namely, Lot One Shoppers’ Mall (Lot One), Bukit Panjang Plaza (90 out of 91 strata lots) (BPP) and Rivervale Mall.

The total purchase consideration of

S$298.1 million for the acquisition is based on an aggregate value of S$710.0 million for the CRS portfolio of properties.

The acquisition has added more than

S$7.7 million to the distributable income of CMT for the year ending 31 December 2007.

CapitaMall Trust Management Limited will continue to pursue other acquisitions that will be yield accretive to the portfolio.

KEY ASSET ENHANCEMENT INITIATIVES

Asset enhancement works remained a key focus for the portfolio in 2007. The following is an update of some of the enhancement works executed during the year.

Raffles City saw the addition of approximately 41,000 Square Foot (sq ft)

of retail Net Lettable Area (NLA) which was completed in January 2008. The asset extended its retail footprint to over

396,000 sq ft through the creation of a new

three-storey island podium, as well as the conversion of Basement 1 carpark and back-of-house area into retail space. These works resulted in additional Net Property Income (NPI) of S$7.6 million per annum on a stabilised basis.

The year also witnessed the completion of a new retail extension block and reconfiguration of internal space in IMM Building (IMM). A new seamless furniture and home styling concept was launched on Level 3. On Level 1, 11 new food kiosks were created. In total, the asset enhancement works contributed an additional NPI of

S$10.0 million per annum.

The asset enhancement works at Tampines Mall, amongst others, included the subdivision of two large units (Courts and Isetan) on Level 2 into 17 specialty units to increase the average rent of the mall and further enhance the variety of retail offerings. The works brought in an incremental annual revenue and NPI of S$2.6 million and

S$2.1 million respectively.

The enhancement of Bugis Junction is also in progress. The first phase focusing on Food & Beverage (F&B) offering enhancement saw the relocation of the food court from Basement 1 to Level 3

of the restaurant block located along Hylam Street. New F&B concepts were also introduced on Level 2 of the same block. In addition, new balconies and glass parapets were created in this block transforming the entire dining ambience at the Hylam Street. A new Market Place in Basement 1 has been created from the space vacated by the food court. Phases 1 and 2 of the Market Place have been completed and the following phase is expected to complete in Second Quarter1 2008 and the various initiatives collectively are expected to create additional NPI of $4.0 million

per annum.

Redevelopment of Sembawang Shopping Centre (SSC) also commenced during the year and is on target for completion in Fourth Quarter2 2008. The works would result in the transfer of almost 80,000 sq ft of gross floor area from the residential block and Levels 3 and 4 to create corresponding amount of more valuable retail space on Basement 1, Levels 1 and 2. In addition, the works would also enhance the overall shopping experience at SSC. The works are expected to incur a capital expenditure of S$68.4 million and create incremental NPI of S$5.5 million per annum, thereby achieving an ungeared return on investment

of 8.0%.

Asset enhancement works at Lot One are also in progress. The creation of a four-storey retail extension block measuring over

16,500 sq ft of NLA started in July 2007. More than 50 new shops will be created from the decanted space occupied by the National Library Board (NLB) under the Civic and Community Institution scheme. NLB will relocate to a larger premise at the mall. The works are expected to incur a capital expenditure of S$51.7 million and create an incremental NPI of S$5.2 million per annum.

LEASE RENEWALS AND NEW LEASES

In 2007, every asset in the portfolio outperformed the forecast rental rates as well as preceding rental rates. As a result, CMT portfolio for the year exceeded forecast rental rates and preceding rental rates by

5.0%3 and 12.0% respectively.

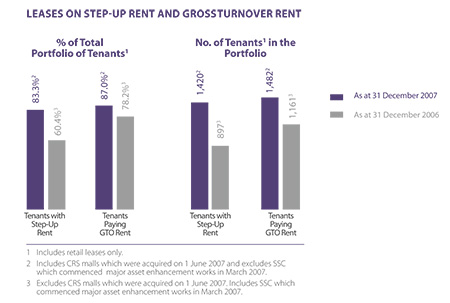

STEP-UP RENT AND GROSS

TURNOVER RENT

The number of tenants with step-up rent and Gross Turnover (GTO) rent registered a significant increase during the year as a result of the acquisition of CRS malls and the completion of asset enhancement works at IMM. The number of tenants on a step-up rent structure increased from 897 (as at

31 December 2006) to 1,420 (as at

31 December 2007). The number of tenants paying GTO rent also grew from 1,161 (as at 31 December 2006) to 1,482 (as at

31 December 2007). |

|

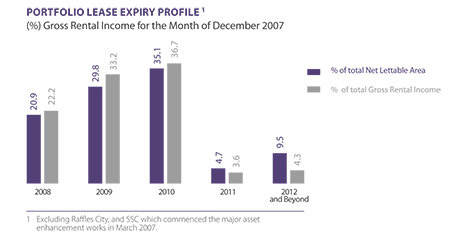

Portfolio Lease Expiry

The lease term of our tenants are consistent with the Singapore retail market, with specialty tenants typically on a three year lease term and anchor tenants on a five to seven year lease term. The portfolio lease expiry remained well spread out as at

31 December 2007. Based on gross rental income, 22.2% and 33.2% of the leases are due for renewal in 2008 and 2009 respectively. |

|

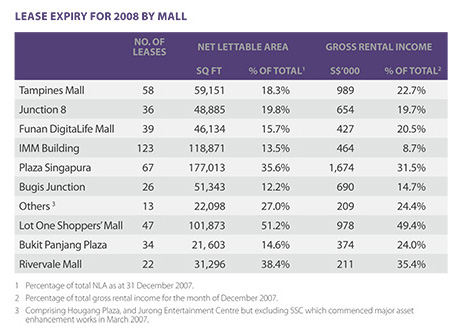

Lease Expiry for 2008 by Mall

The largest number of lease renewals is expected at IMM in 2008 as tenants have been generally signed up on shorter lease terms to facilitate the recent asset enhancement works. Similarly, to facilitate asset enhancement works, Lot One has 47 leases expiring in 2008, which account for 49.4% of total gross rental income. |

|

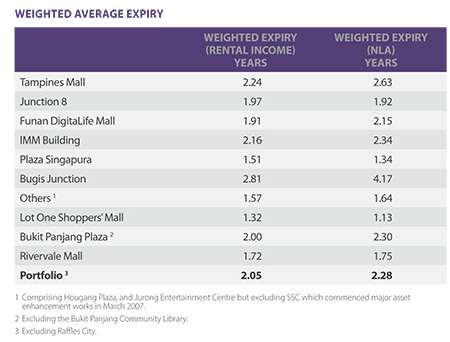

Weighted Average Expiry

The weighted expiry of the portfolio by gross rental income and NLA is 2.05 years and

2.28 years respectively. |

|

TOP TEN TENANTS

CMT’s gross rental income contribution is well distributed within its portfolio of over 2,100 leases. As at 31 December 2007, BHG was the largest tenant in terms of gross rental income and NLA, accounting for 3.6% and 6.8% of the total portfolio respectively. Collectively, the top ten tenants accounted for about 21.6% of total gross income

for CMT.

TRADE SECTOR ANALYSIS

F&B outlets/food courts remained the largest contributor to gross rental income and occupied the most space. It contributed to 25.0% of total gross rental income and occupied 16.6% of the total NLA in 2007. The fashion trade is the second largest contributor to gross rental income at 21.5%, while occupying only 8.5% of the total portfolio NLA. This indicates that the portfolio is well diversified and not over reliant on any single tenancy group to deliver its income.

OPPORTUNITY FOR TRADE REMIXING TO OPTIMISE RENTAL

In enhancing the retail mix to introduce variety and boost shopper traffic, a key focus is to rebalance the trade mix to improve the average rent of each mall. As a result, more space was allocated to trades which are popular with shoppers and paying higher rentals. Similarly, the traditional dominant presence of department stores in the malls is also reviewed to strike a balance between enhancing retail variety and increasing average rental. As a result, space occupied by F&B increased from 15.4% in 2006 to 16.6% in 2007. On the other hand, space occupied by department stores reduced from 10.0% in 2006 to 9.6% in 2007. These various trade remixing initiatives led to the increase of the portfolio’s average gross rental from S$8.62 per sq ft per month in 2006 to S$9.27 in 2007 per sq ft

per month.

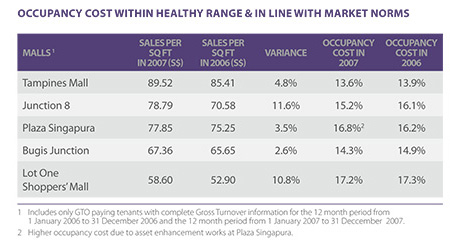

OCCUPANCY COST

The information collected for Tampines Mall, Junction 8, Plaza Singapura, Bugis Junction and Lot One indicated that the occupancy cost of our tenants were within a healthy range and in line with the market norms. The occupancy costs ranged between 13.6% to 17.2% in 2007, and 13.9% to 17.3% in 2006. |

|

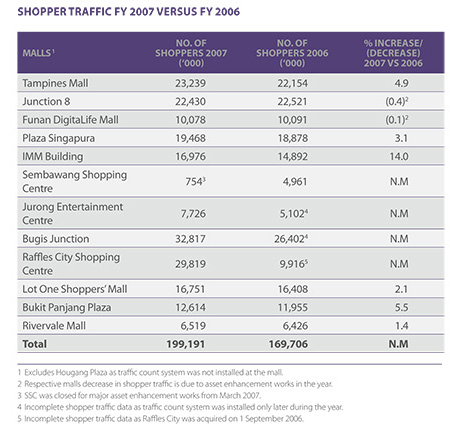

SHOPPER TRAFFIC

The benefits of the various asset enhancement initiatives manifested through a steadily increasing shopper traffic across the portfolio. The number of shoppers increased from 169.7 million in 2006 to 199.2 million shoppers in 2007. Three malls, namely Tampines Mall, Plaza Singapura and IMM registered a record traffic flow of 23.2 million, 19.5 million and 17.0 million shoppers respectively in 2007. |

|

|