Unit Price Performance

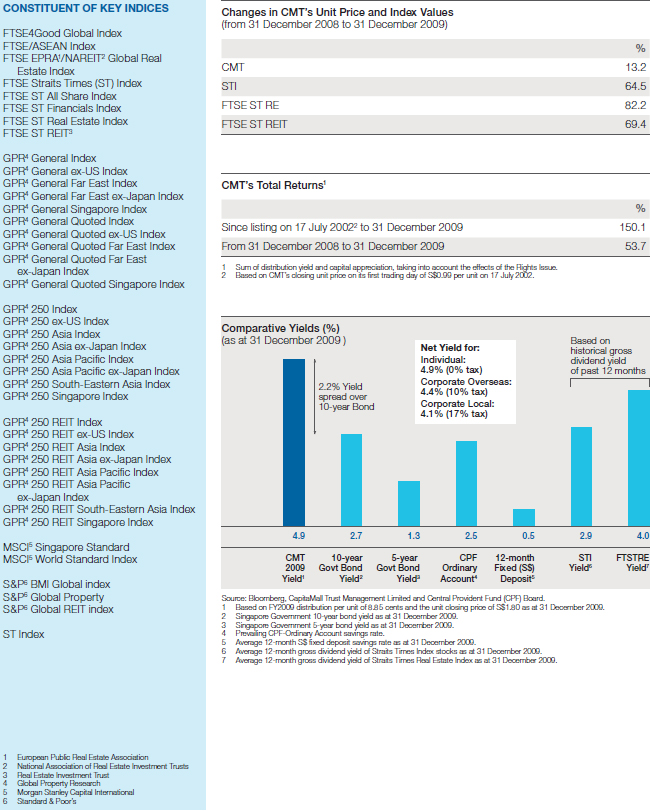

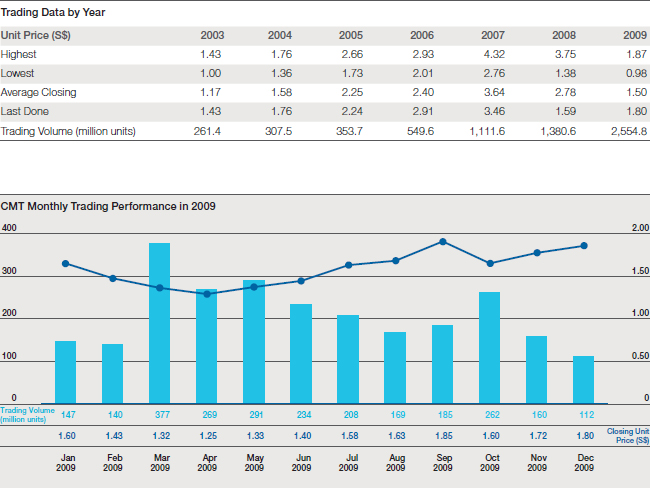

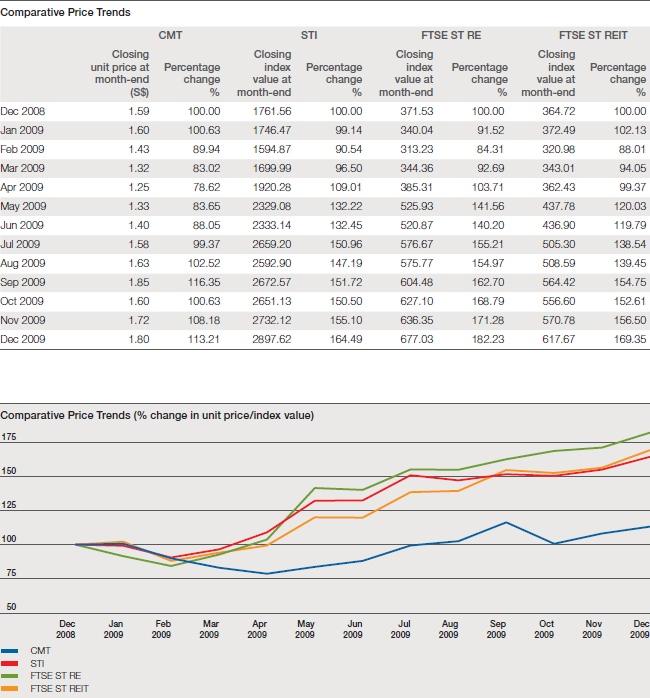

Financial markets worldwide started 2009 on a sombre note as the global recession deepened. By December 2009, as global equities gained back much of their losses from 2008, CMT's unit price strengthened to close at S$1.80 on 31 December 2009. This was 13.2% higher than the closing unit price of S$1.59 on 31 December 2008. The Singapore stock market ended the year 64.5% higher on emerging signs of a recovery in the local and global economies. Market concerns over a share overhang due to a proposed underwritten renounceable 9-for-10 rights issue (Rights Issue) kept CMT's unit price under pressure during the first quarter of 2009. The exercise which was announced in early February 2009, was subsequently approved by Unitholders during an extraordinary general meeting in March.

Following the completion of the rights issue, CMT's unit price traded above its theoretical ex-rights price1 of S$1.15 for the rest of the year. CMT's stock liquidity almost doubled, registering a 85.0% jump in trading volume from 1.4 billion units in 2008 to 2.6 billion units in 2009.

- Computation of theoretical ex-rights price is based on the closing unit price of CMT on 6 February 2009.

Source: Bloomberg

STI refers to Straits Times Index.

FTSE ST RE refers to FTSE ST Real Estate Index.

FTSE ST REIT refers to FTSE ST Real Estate Investment Trust Index.