Risk & Capital Management

(1) Risk Management

(1) Risk Management

Effective enterprise-wide risk management is a fundamental part of CMT's business strategy. The potential risks are identified and key controls to mitigate these risks are established to protect Unitholders' interests and value.

Key Risks & Control Measures

Operational Risk

To mitigate and manage operational risk, CMT and its subsidiaries (CMT Group or Group) has integrated risk management into the day-to-day activities across all functions. These include planning and control systems, group-wide guidelines, information technology systems, and operational reporting and monitoring procedures involving the executive management committee and Board of Directors. The risk management system is regularly monitored and examined to ensure effectiveness.

The risk management framework is designed to ensure appropriate processes and procedures are in place to prevent, manage and mitigate any operational risk.

Investment Risk

One of the main sources of growth for CMT Group is the acquisition of properties and asset enhancement initiatives (AEI). The risks involved in such investment activities are managed through a rigorous set of investment criteria which includes yield accretion, rental sustainability, CMT's portfolio fit and market catchment. The key financial projection assumptions are reviewed and sensitivity analyses are conducted on key variables.

The potential risks associated with proposed projects and the issues that may prevent their smooth implementation or projected outcomes are identified at evaluation stage. This enables us to determine actions that need to be taken to manage or mitigate risks as early as possible.

Interest Rate Risk

The Group's exposure to changes in interest rates relates primarily to interest-bearing financial liabilities. Interest rate risk is managed on an ongoing basis with the primary objective of limiting the extent to which net interest expense could be affected by adverse movements in interest rates. CMT Group proactively seeks to minimise the level of interest rate risk by locking in most of its borrowings at fixed interest rates. As at 31 December 2010, the risk is minimal as 98.7% of its borrowings are based on fixed rates.

Currency Risk

As the assets of CMT Group are currently based in Singapore, there is little or no foreign exchange exposure from operations. CMT borrows in Singapore dollars from a special purpose vehicle, Silver Maple Investment Corporation Ltd (Silver Maple) and its wholly-owned subsidiary, CMT MTN Pte. Ltd. (CMT MTN). CMT MTN is a wholly-owned subsidiary of CMT which provides treasury services, including on-lending to CMT the proceeds from issuances of notes under the S$2.5 billion unsecured Multicurrency Medium Term Note Programme (MTN Programme) and US$2.0 billion unsecured Euro-Medium Term Note Programme (EMTN Programme), which were swapped into Singapore Dollars.

RCS Trust for which CMT has a 40.00% interest, borrows in Singapore dollars from another special purpose vehicle, Silver Oak Ltd (Silver Oak). Both Silver Maple and Silver Oak issued foreign denominated notes at floating rates and are able to obtain attractive spreads by borrowing from the overseas markets. They were swapped into fixed rate and Singapore Dollars.

Credit Risk

Credit risk is the potential earnings volatility caused by tenants' inability and/or unwillingness to fulfill their contractual lease obligations, as and when they fall due. There is a stringent collection policy in place to ensure that credit risk is minimised. Other than the collection of security deposits, which amount to an average of three months' rent in the form of cash or bankers' guarantee, CMT Group also has a vigilant monitoring and debt collection procedures. Debt turnover of CMT Group as at 31 December 2010 of 2.6 days has marginally improved, compared with 2.8 days as at 31 December 2009.

Liquidity Risk

CMT Group actively monitors its cash flow position to ensure that there are sufficient liquid reserves in terms of cash and credit facilities to finance its operation. The Group diligently monitors and observes bank covenants for borrowings.

Financing Risk

The health of the debt markets directly affects CMT, given our inherent need for external sources of funding to refinance the existing borrowings or to fund the new acquisition or AEI.

CMT will continue to manage its capital structure proactively by spreading out its debt due for refinancing for each year to a manageable size and maintaining an optimal gearing level.

Legal and Compliance Risk

Due to the nature of CMT's business, it is required to comply with the relevant laws and regulations, including the Listing Manual of the SGX-ST (Listing Manual), the Code on Collective Investment Schemes (the CIS Code) issued by the Monetary Authority of Singapore (MAS) and the tax rulings issued by the Inland Revenue Authority of Singapore on the taxation of CMT and its Unitholders. Therefore, any changes in these regulations may affect CMT's operations and results.

Legal risk is the risk that CMT's reputation may be adversely affected as a result of business activities which may bring about unintended or unexpected legal consequences.

The manager of CMT (the Manager) has established procedures to ensure compliance with applicable legislation and regulations and such procedures are monitored by the Audit Committee who is authorised to investigate any matters within its terms of reference.

Interested Person Transaction Risk

In general, the Manager has established internal control procedures to ensure that all future transactions involving the Trustee and a related party of the Manager (Interested Person Transactions) are undertaken on an arm's length basis and on normal commercial terms, which are generally no more favourable than those extended to unrelated third parties.

In respect of such transactions, the Manager would have to demonstrate to the Audit Committee that the transactions are undertaken on normal commercial terms which may include obtaining (where practicable) quotations from parties unrelated to the Manager, or obtaining valuations from independent valuers (in accordance with the Property Funds Appendix). Proactive measures are also adopted to avoid situations of conflict and potential conflict of interest.

Human Resource Risk

In order to deliver quality products and services to our

valued tenants and customers, it is necessary to invest in

quality human capital. This should be done by recruiting and

retaining skilled and professional employees with the relevant

expertise. High turnover rate of these valued employees can

be detrimental as it causes disruption in CMT's business

operations and undermines the implementation of CMT's

strategic business plans.

CMT has adopted an integrated human capital strategy to recruit, develop and motivate employees. Other than seeking outstanding talents with the relevant expertise and experience, emphasis has also been placed on managing these talents through staff development and continuous training. To further retain these talents, comprehensive compensation and benefits plans are used to motivate and reward our staff. Such measures ensure that the employees are skillfully trained and retained and allow us to retain our competitive edge.

(2) Capital Management

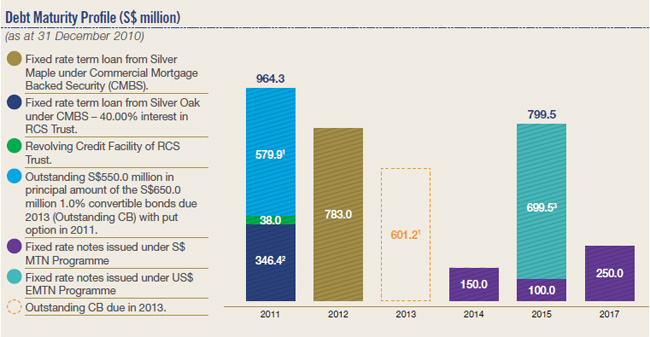

Under the facility agreement between Silver Maple and CMT, Silver Maple has granted and loaned CMT a total term loan facility of S$783.0 million. This was after CMT repaid S$125.0 million term loan under the facility on 26 June 2010.

In April 2010, CMT MTN issued US$500.0 million (equivalent to S$699.5 million) notes through its EMTN Programme and S$500.0 million notes through its MTN Programme. During the year, CMT repaid S$315.0 million notes under the MTN Programme.

In October 2010, CMT repurchased S$100.0 million of the S$650.0 million 1.0% convertible bonds due 2013 (CB). Following the settlement, the repurchased CB has been cancelled proportionately, and the outstanding aggregate principal amount of CB is currently S$550.0 million.

- Excludes unamortised transaction costs.

- Based on the outstanding S$550.0 million in principal amount of the S$650.0 million 1.0% convertible bonds due 2013 (Outstanding CB). The final redemption price upon maturity on 2 July 2013 is equal to 109.31% of the principal amount. The Outstanding CB may be redeemed in whole or in part, at the option of the bondholders on 2 July 2011 at 105.43% of the principal amount.

- Includes US$500.0 million fixed rate notes issued through the EMTN Programme which were swapped to S$699.5 million at a fixed rate of 3.794% per annum in April 2010.

- CMT's 40.00% interest in RCS Trust.

CMT has a 40.00% interest in RCS Trust. Under the facility agreement between Silver Oak and RCS Trust, Silver Oak has granted a total facility of S$1,030.0 million, consisting of a S$866.0 million term loan and a S$164.0 million Revolving Credit Facility (RCF). RCS Trust drew down the S$866.0 million term loan in September 2006 and as at 31 December 2010, S$95.0 million has been drawn down from the RCF. CMT Group's 40.00% interest thereof is S$346.4 million and S$38.0 million of term loans and RCF respectively.

In summary, the total borrowings of CMT Group as at 31 December 2010 was S$2,916.91 million, with gearing at 35.9%.

The loan maturity profile for CMT Group as at 31 December 2010 was as follows:

- Based on principal sums only.

As at 31 December 2010, 32.0% or S$934.4 million of CMT Group's debt will mature in 2011. CMT has sufficient internal resources and existing bank facilities to cover the repayments due in 2011. The Manager will continue to adopt a rigorous and focused approach to capital management.

Average cost of debt for CMT Group for Financial Year (FY) 2010 has increased slightly to 3.7% per annum compared with 3.5% per annum for the FY 2009 mainly due to the repayment of the loans upon maturity which have lower interest rates.

Cash Flows and Liquidity

CMT Group takes a proactive role in monitoring its cash and liquid reserves to ensure adequate funding is available for distribution to the Unitholders as well as to meet any short term liabilities.

Operating Activities

Operating net cash flow for FY 2010 was S$383.2 million, an increase of S$27.6 million over the operating cash flow of S$355.6 million in the preceding FY. This was mainly due to higher Net Property Income (NPI). NPI grew 5.9% or S$22.3 million from S$376.8 million in FY 2009 to S$399.1 million with the acquisition of Clarke Quay and higher rental rates achieved from new and renewed leases and step-up rents.

Investing Activities

CMT Group continued its acquisition strategy and increased the number of properties in the portfolio from 14 to 15 with the acquisition of Clarke Quay. This further strengthens CMT's lead as Singapore largest real estate investment trust by asset size and market capitalisation. After going through the tough market environment, the Group has become more prudent in its capital requirements for new acquisitions and AEI. CMT Group will focus on possible acquisition opportunities and pursue selective greenfield development projects that have the ability to create value in the long term.

Financing Activities

CMT Group continued to adopt a rigorous and focused approach to monitor the cash position and level of borrowings with the view of strengthening its capital structure and competitive position.

- The Outstanding CB may be redeemed in whole or in part at the option of bondholders on 2 July 2011 at 105.43% of the principal amount. The final redemption price upon maturity on 2 July 2013 is equal to 109.31% of the principal amount.

- CMT's 40.00% share of CMBS taken at RCS Trust level to part finance the Raffles City Singapore acquisition. Of the total CMBS of S$866.0 million, S$136.0 million (40.00% share thereof is S$54.4 million) is "AA" rated, the balance is "AAA" rated.

- US$500.0 million fixed rate notes were swapped to S$699.5 million at a fixed interest rate of 3.794% per annum in April 2010.

Cash And Cash Equivalents

As at 31 December 2010, the value of cash and cash equivalents of CMT Group stood at S$712.9 million compared with S$350.8 million as at 31 December 2009. The higher quantum was mainly due to the balance of the net proceeds from the issuance of notes from the MTN Programme.

(3) Accounting Policies

The financial statements have been prepared in accordance with the Statement of Recommended Accounting Practice (RAP) 7 "Reporting Framework for Unit Trusts" issued by the Institute of Certified Public Accountants of Singapore, and the applicable requirements of the CIS Code issued by MAS and the provisions of the Trust Deed.