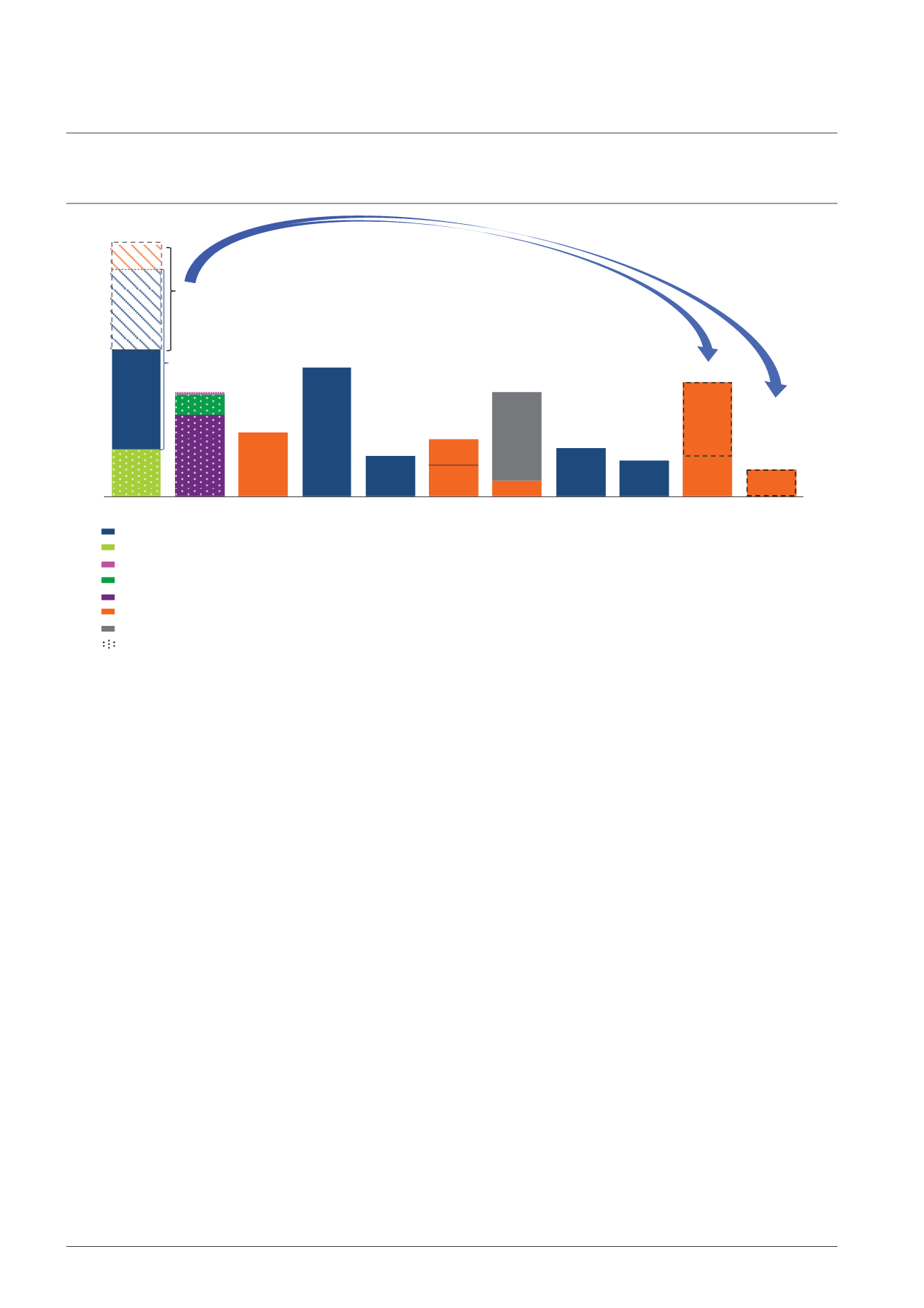

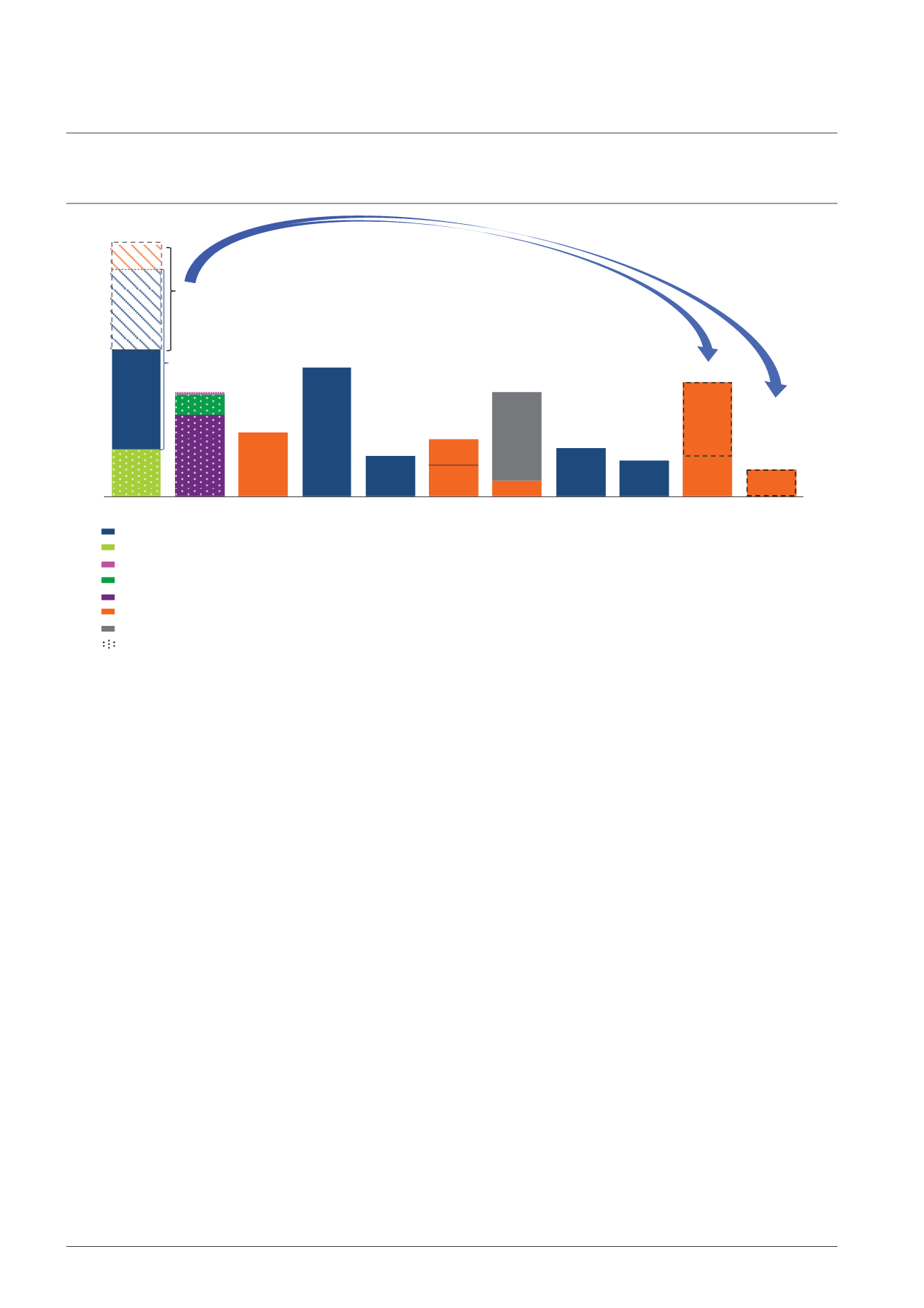

Debt Maturity Profile as at 31 December 2014

(including CMT’s 40.00% interest in RCS Trust and CMT’s 30.00% interest in Infinity Trusts)

(S$ million)

505.2

6

157.6

7

190.1

10

140.0

11

100.0

250.0

62.0

9

108.3

12

320.0

12.0

3

350.0

985.1

1

412.0

226.0

412.0

450.0

2015

2016

2017

2018

2019

2020

2021

2022

2023

2024

2025

Silver Oak: Silver Oak Ltd. CMBS: Commercial mortgage backed securities

185.6

2

80.0

4

320.0

5

126.0

8

100.0

150.0

300.0

Funding

partially

raised for

refinancing

408.3

699.5

Notes issued under Euro-Medium Term Note (EMTN) Programme

Secured Banking Facilities - 30.00% interest in Infinity Trusts

Secured revolving credit facility from Silver Oak - 40.00% interest in RCS Trust

Secured term loan from Silver Oak - 40.00% interest in RCS Trust

Secured CMBS from Silver Oak - 40.00% interest in RCS Trust

Notes issued under MTN Programme

Retail Bonds due 2021 at fixed rate of 3.08% per annum (p.a.)

Debts with secured assets

1 Includes US$500.0 million 4.321% fixed rate notes which were swapped to S$699.5 million at a fixed interest rate of 3.794%

p.a. in April 2010.

2 S$618.6 million secured banking facilities by Infinity Trusts. CMT’s 30.00% share thereof is S$185.6 million. The secured

banking facilities are repayable on the earlier of (i) the date 12 months after the Final Temporary Occupation Permit (TOP) date

for the mixed development which comprises Westgate and Westgate Tower or (ii) 60 months after date of facility agreement.

Westgate has commenced operations on 2 December 2013 and Westgate Tower has obtained TOP on 9 October 2014.

3 Drawdown of S$30.0 million under Silver Oak from the S$300.0 million revolving credit facility. CMT’s 40.00% share thereof is

S$12.0 million.

4 S$200.0 million five-year term loan under Silver Oak. CMT’s 40.00% share thereof is S$80.0 million.

5 US$645.0 million in principal amount of Class A Secured Floating Rate Notes with expected maturity on 21 June 2016 issued

pursuant to the S$10.0 billion Multicurrency Secured Medium Term Note Programme established by Silver Oak and are

secured by its rights to Raffles City Singapore. The proceeds have been swapped into S$800.0 million. CMT’s 40.00% share

thereof is S$320.0 million.

6 US$400.0 million 3.731% fixed rate notes were swapped to S$505.2 million at a fixed rate of 3.29% p.a. in March 2012.

7 ¥10.0 billion 1.309% fixed rate notes were swapped to approximately S$157.6 million at a fixed rate of 2.79% p.a. in October

2012.

8 ¥10.0 billion 1.039% fixed rate notes were swapped to S$126.0 million at a fixed rate of 3.119% p.a. in November 2013.

9 ¥5.0 billion floating rate (at 3-month JPY LIBOR + 0.48% p.a.) notes were swapped to S$62.0 million at a fixed rate of 3.148%

p.a. in February 2014.

10 HK$1.15 billion 3.76% fixed rate notes were swapped to S$190.1 million at a fixed rate of 3.45% p.a. in June 2012.

11 HK$885.0 million 3.28% fixed rate notes were swapped to S$140.0 million at a fixed rate of 3.32% p.a. in November 2012.

12 HK$650.0 million 3.25% fixed rate notes were swapped to S$108.3 million at a fixed rate of 3.25% p.a. in November 2014.

Capital Management

76 | CapitaMall Trust Annual Report 2014