78

CapitaLand Mall Trust

Annual Report 2015

Financial Review

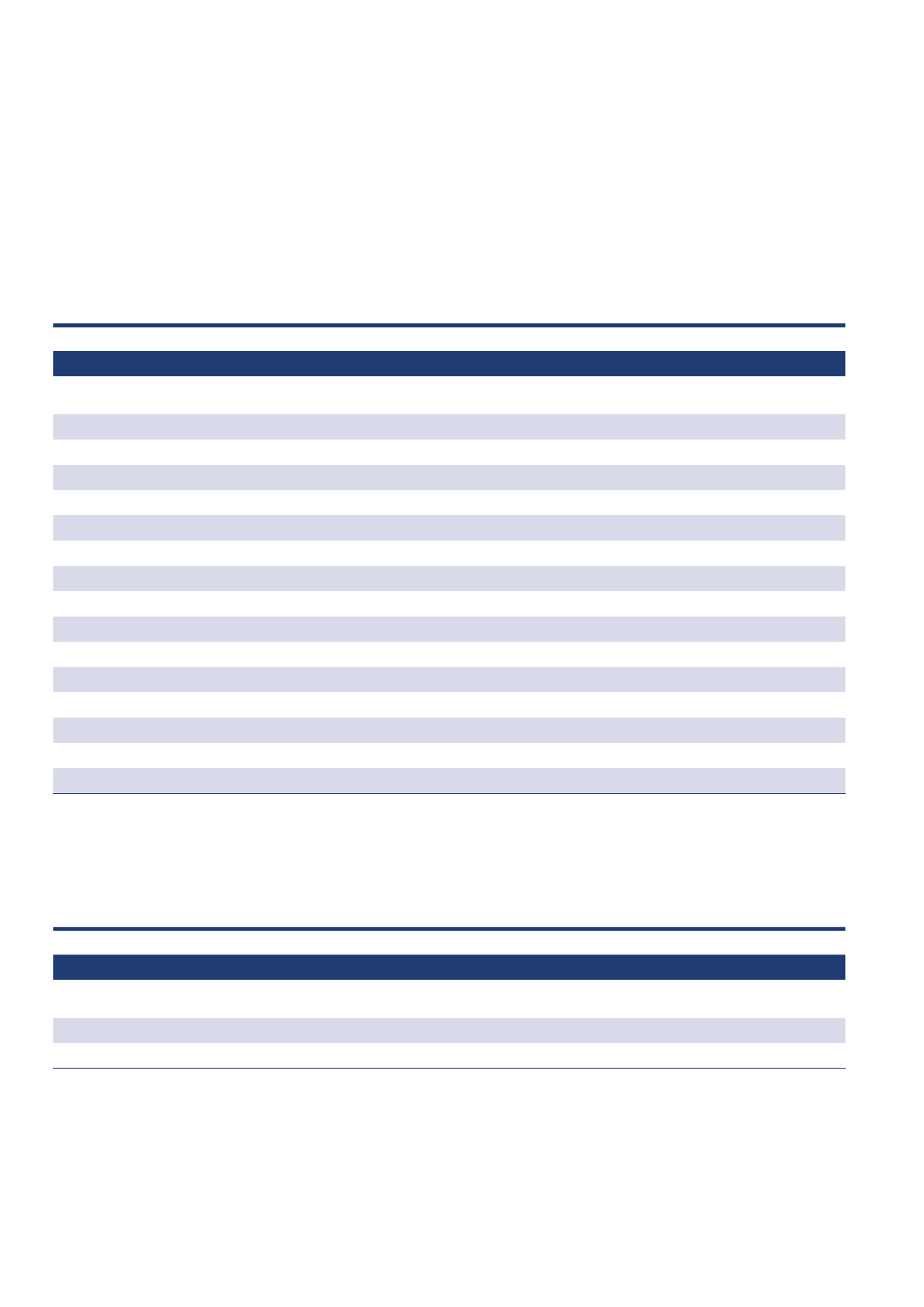

Net Property Income

As a result of the higher gross revenue, net property

income (NPI) of S$466.2 million was S$17.8 million

or 4.0% higher than the S$448.4 million for FY 2014.

This was mainly due to Bedok Mall which was acquired

1 The sale of Rivervale Mall was completed on 15 December 2015.

2 The acquisition of Brilliance Mall Trust which holds Bedok Mall was completed on 1 October 2015.

on 1 October 2015 and BJ which completed its phase

two AEI in September 2014. The above was partially

offset by lower NPI from IMM, JCube and CQ as a

result of lower gross revenue.

Net Property Income by Property

(S$ million)

FY 2015

FY 2014

Tampines Mall

56.8

55.0

Junction 8

41.9

40.7

Funan DigitaLife Mall

22.8

21.7

IMM Building

46.8

50.3

Plaza Singapura

67.8

66.6

Bugis Junction

62.0

53.9

Sembawang Shopping Centre and Rivervale Mall

1

14.9

14.4

JCube

13.1

15.9

Lot One Shoppers’ Mall

30.7

29.5

Bukit Panjang Plaza

17.2

17.1

The Atrium@Orchard

39.0

37.8

Clarke Quay

20.9

23.1

Bugis+

22.0

22.4

CMT Trust

455.9

448.4

Bedok Mall

2

10.3

-

CMT Group

466.2

448.4

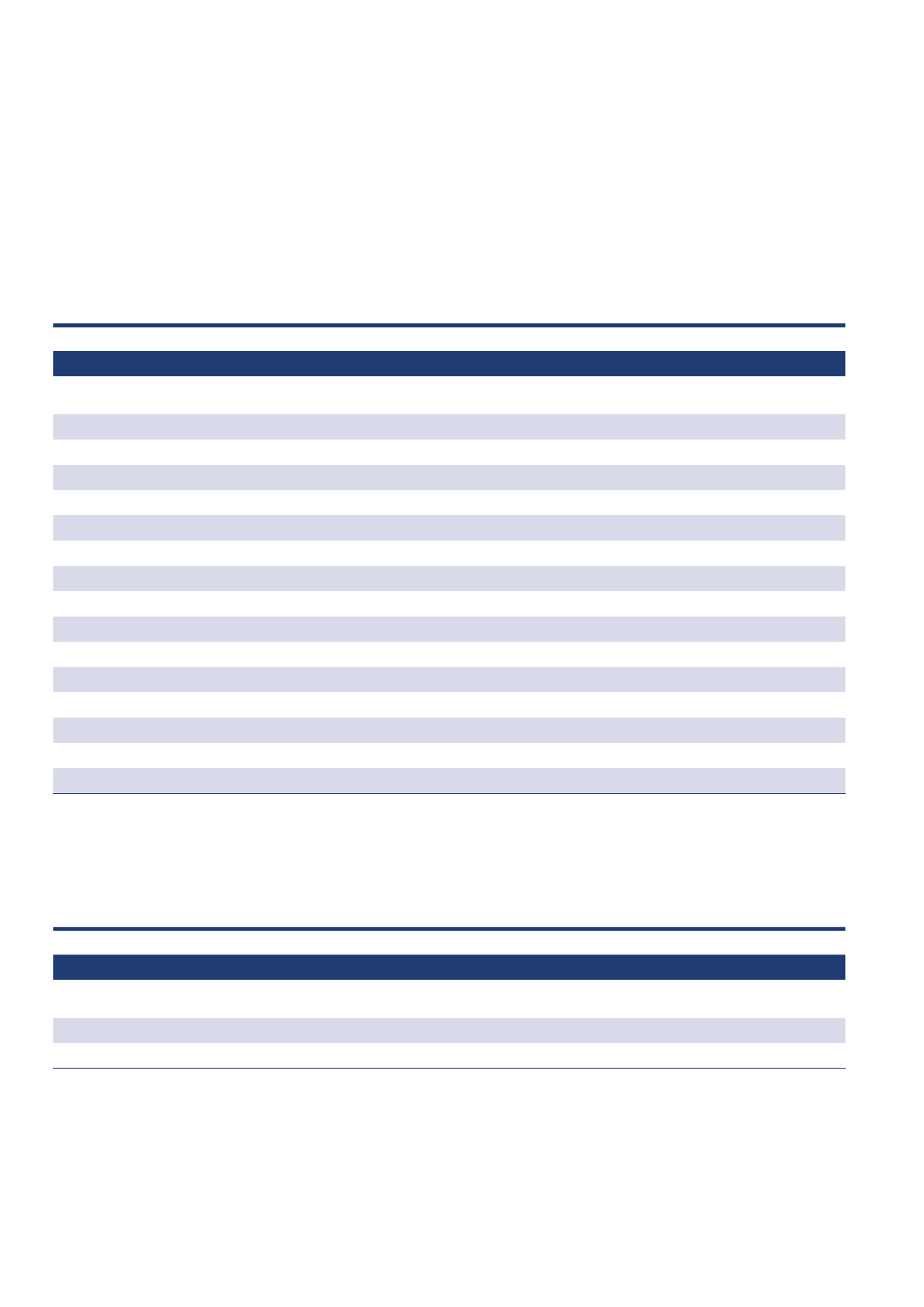

Net Property Income by Property

(S$ million)

FY 2015

FY 2014

Raffles City Singapore (40.00% interest)

69.2

68.1

Westgate (30.00% interest)

16.9

13.6

Total

86.1

81.7

CMT’s interest in joint ventures’ NPI are shown below for information: