70

CapitaLand Mall Trust

Annual Report 2015

Operations Review

1 Includes CMT’s 40.00% interest in Raffles City Singapore (excluding hotel lease) and CMT’s 30.00% interest in Westgate.

2 Based on actual gross rental income for the month of December 2015 and excludes gross turnover rent.

3 Includes tenants approved as thematic dining, entertainment and a performance centre in Bugis+.

4 Others include Art Gallery and Luxury.

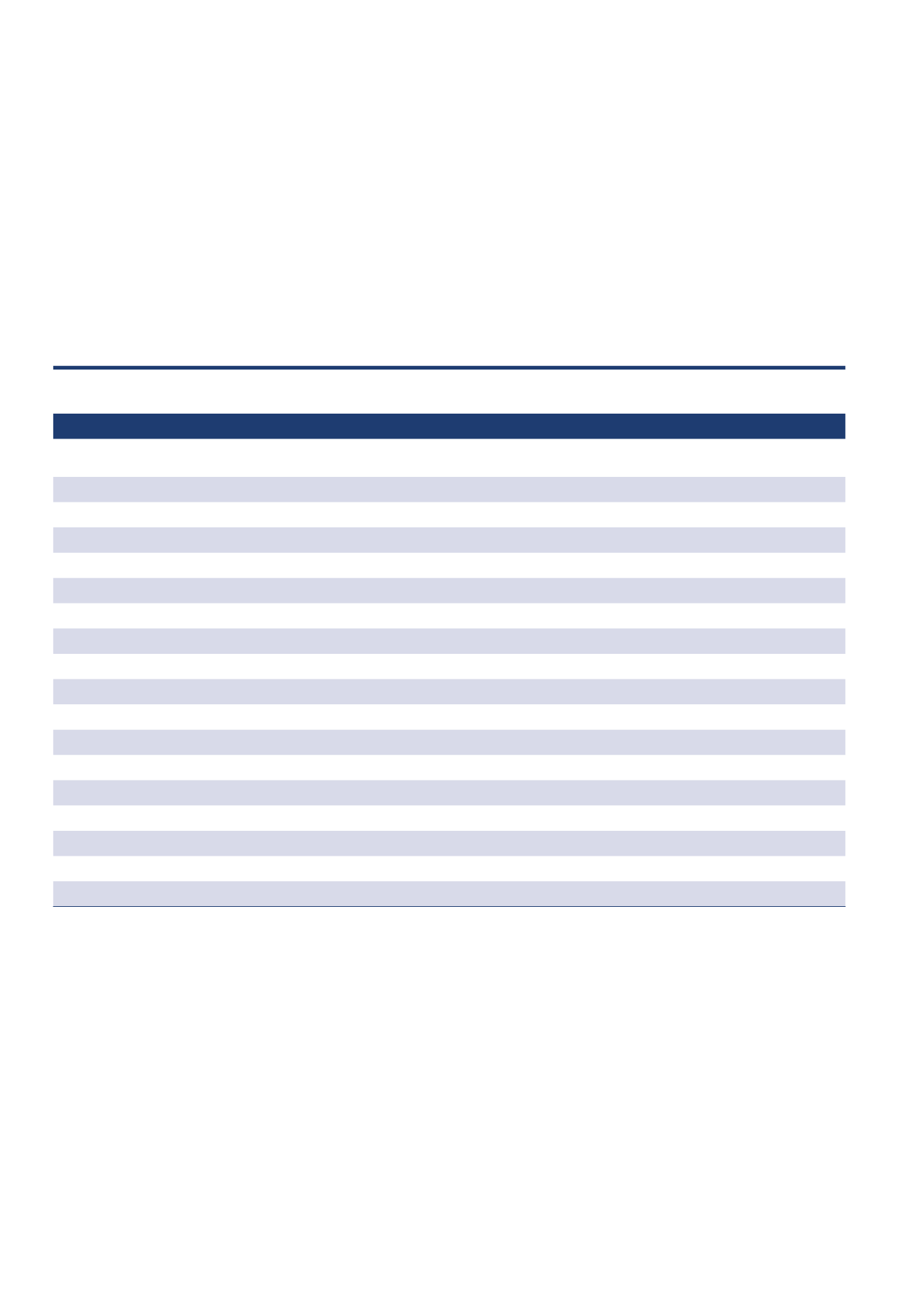

Breakdown of CMT Portfolio

1

by Trade Sector

(For the month of December 2015)

% of Gross Rental Income

2

Food & Beverage

29.0

Fashion

14.1

Beauty & Health

10.4

Services

6.8

Department Store

5.6

Gifts & Souvenirs / Toys & Hobbies / Books & Stationery / Sporting Goods

5.2

Shoes & Bags

4.6

Leisure & Entertainment / Music & Video

3

4.4

Supermarket

3.9

Office

3.1

Jewellery & Watches

2.6

Home Furnishing

2.5

Information Technology

2.3

Electrical & Electronics

2.2

Education

1.3

Warehouse

1.3

Others

4

0.7

Total

100.0

Trade Sector Analysis

CMT’s portfolio is well diversified and leverages on many different trade sectors for rental income. As at

31 December 2015, Food & Beverage (F&B) remained the largest contributor to gross rental income at 29.0% of

the total portfolio. Fashion remained the second largest contributor to gross rental income at 14.1%.

Approximately 75.0% of CMT’s malls in the portfolio caters to the necessity shopping segment, in terms of gross

revenue and asset valuation.