INTRODUCTION

TRACK RECORD OF VALUE CREATION

OUR SHOPPERS' SPEAK

OUR TENANTS SPEAK

|

(4) |

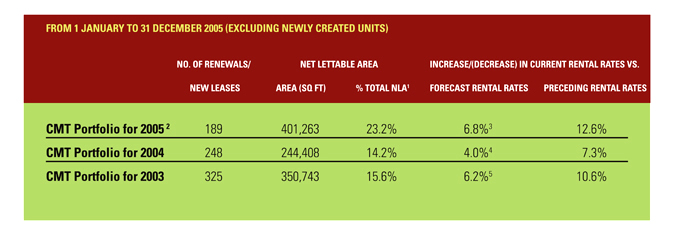

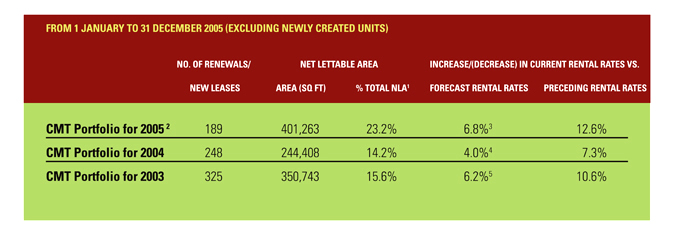

STRONG RENTAL RENEWAL RATES |

| |

• |

We have been able to achieve healthy renewal rates versus forecast and preceding

rental rates through our proactive asset planning and leasing strategy. |

|

|

1 |

As at 31 December 2003, 31 December 2004 and 31 December 2005 respectively. |

2 |

Excluding Hougang Plaza Units, Sembawang Shopping Centre, Bugis Junction and

Jurong Entertainment which were acquired in 2005. Only

renewal of retail units not budgeted to be affected by

asset enhancement works were taken in to account, 149 units

originally budgeted to be affected by asset enhancement

works at level 2 and level 3 of IMM building were excluded

from the the analysis. |

3 |

Forecast rental rates for the period 1 January 2005 to 30 October 2005 is the

basis for forecast shown in the CMT Circular dated 20 July

2004 and the forecast rental rates for the period 31 October

2005 to 31December 2005 is the basis for forecast shown

in the CMT Circular dated 18 October 2005. |

4 |

Forecast rental rates for the period 1 January 2004 to 1 August 2004 is the basis

for forecast shown in the CMT Circular dated 11 June

2003 and the forecast rental rates for the period 2 August

2004

to 31December 2004 is the basis for forecast shown

in the CMT Circular dated 20 July 2004. |

5 |

Forecast rental rates for the period 1 January 2003 to 25 June 2003 is the basis

for forecast shown in the CMT Offering Circular dated 28

June 2002 and the forecast rental rates for the period

26 June 2003 to31 December 2003 is the basis for forecast

shown in the CMT Circular dated 11 June 2003. |

|

(5) |

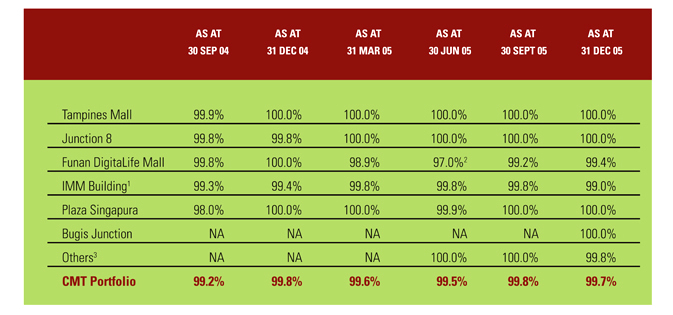

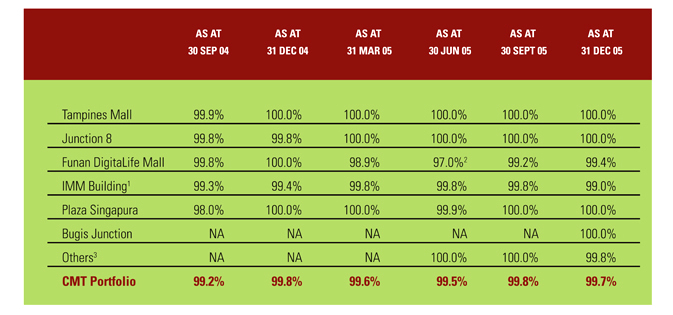

HIGH OCCUPANCY RATES |

| |

• |

We have achieved consistently high occupancy rates of close to 100.0 percent

at all malls within the portfolio. |

|

|

1 |

Information is based on retail space only. |

2 |

Lower occupancy rate due to reconfi guration of units on Level 2.

|

3 |

Comprising Hougang Plaza Units, Sembawang Shopping Centre and Jurong Entertainment

Centre.5.

|

|

| (6) |

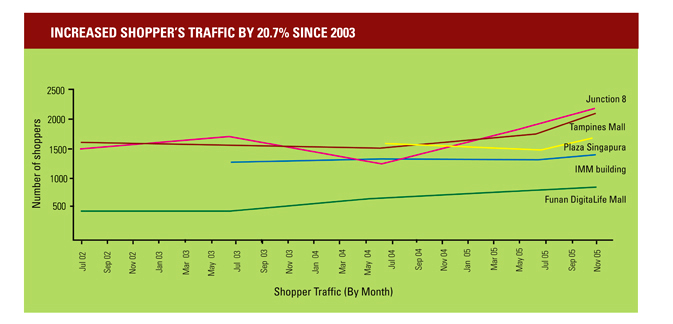

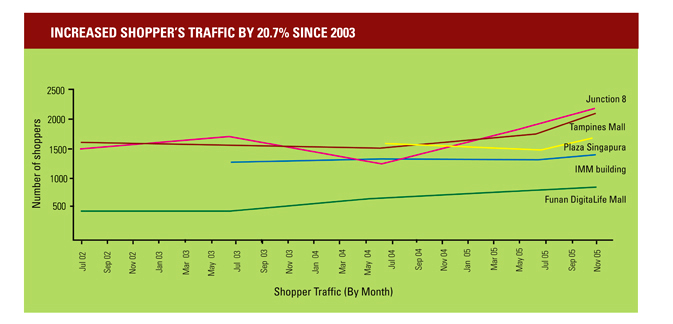

INCREASING SHOPPERS’ TRAFFIC |

| |

• |

Through proactive management of our malls, we have successfully increased shoppers’

traffi c by 20.7 1 percent since 2003. |

|

|

|

1 |

Based on a total traffi c of 70,171,000 in 2003 and a total traffi c of 84,706,000

in 2005 at Tampines Mall, Junction 8, Funan DigitaLife Mall,

IMM Building and Plaza Singapura. |

2 |

Lower shoppers’ traffi c due to asset enhancement works.

|

|

| |

|