INTRODUCTION | INGENIOUS VALUE CREATION & GROWTH STRATEGIES | IN CONVERSATION | INSIGHTS INTO GROWTH | INSPIRING LEADERSHIP

INTEGRATING PEOPLE & SOCIETY | INVESTOR RELATIONS | IN REVIEW | INCREASING DOMINANCE | IN DETAILS

Operations Review

The acquisitions added another $9.6 million to the Net Property Income of the portfolio for the year ending 2005. The Manager will continue to pursue other acquisitions that will be yield-accretive to the portfolio.

Yield-accretive Acquisitions

In 2005, CapitaMall Trust (CMT) acquired four malls: Sembawang Shopping Centre (10 June 2005), 96.7 percent of the strata area of Hougang Plaza (progressively on 20 June 2005, 30 June 2005 and 16 August 2005), Jurong Entertainment Centre (31 October 2005) and Bugis Junction (31 October 2005).

Bugis Junction is the largest of the four malls and is located at the heart of Singapore’s Arts, Culture, Learning and Entertainment Hub. The mall is directly connected to the Bugis Mass Rapid Transit station and is well served by major bus routes.

The acquisitions added another $9.6 million to the Net Property Income (NPI) of the portfolio for the year ending 2005. CapitaMall Trust Management Limited (CMTML), the Manager of CMT, will continue to pursue other acquisitions that will be yield-accretive to the portfolio.

Key Asset Enhancement Initiatives

One of the major asset enhancement works completed in 2005 was the revamp of food kiosks at Basement 1 of Tampines Mall. The number of kiosks was increased from 13 to 18 and the work contributed approximately S$0.4 million per annum of additional revenue to the portfolio.

Junction 8 saw the completion of its Open Landscaped Plaza on Level 3, which will be used to host more activities and events to attract people to the mall and increase sales for the retailers.

Other asset enhancement works completed in 2005 include the creation of InBox 5 at Funan DigitaLife Mall, four glass kiosks at IMM Building (IMM), various reconfiguration and relocation works at Plaza Singapura, and the amalgamation of two shop units to create a new food court at Jurong Entertainment Centre. In total these works have resulted in approximately S$1.7 million of additional revenue per annum.

PERFORMANCE

Revenue

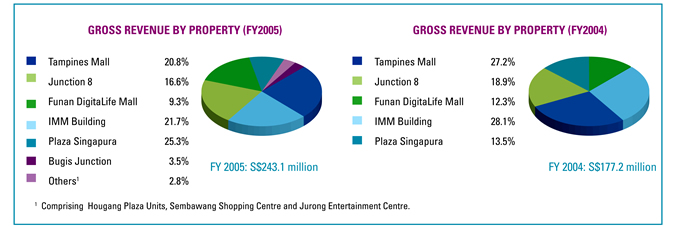

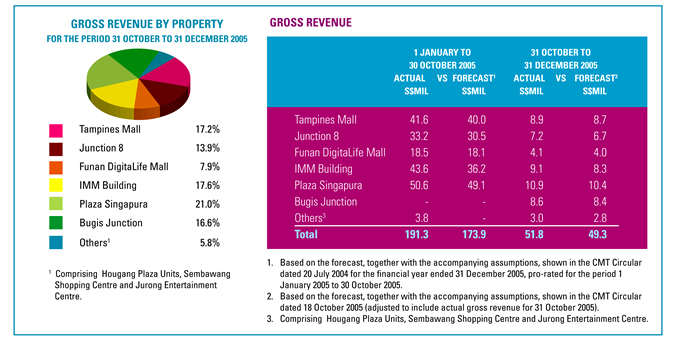

Gross revenue for the financial year ended 31 December 2005 was S$243.1 million, an increase of S$65.9 million or 37.2 percent over S$177.2 million for the financial year ended 31 December 2004. The higher revenue was mainly due to the full-year contribution from Plaza Singapura of S$61.5 million, against S$23.9 million for the period from 2 August 2004 to 31 December 2004. Also contributing to the higher gross revenue were new acquisitions, namely Sembawang Shopping Centre, Hougang Plaza Units, Jurong Entertainment Centre and Bugis Junction, increased rental income from the other malls and the newly created retail spaces at Junction 8, some of which were only completed in December 2004.

Net Property Income

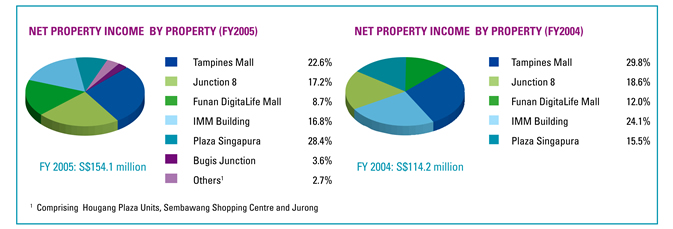

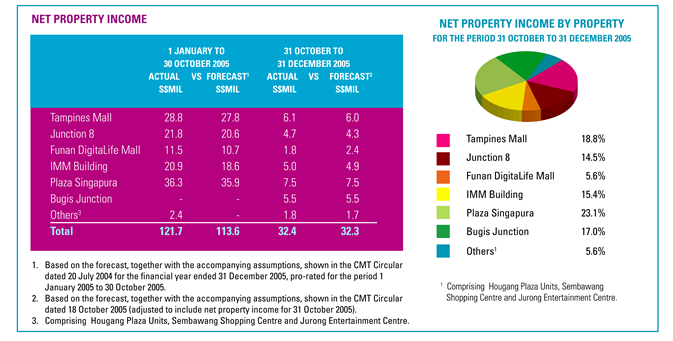

As a result of the higher gross revenue, NPI for the full year ended 31 December 2005 was S$154.1 million, an increase of S$39.9 million or 34.9 percent over S$114.2 million for the financial year ended 31 December 2004. Similarly, this was mainly due to the increase of S$26.1 million from the full-year contribution of S$43.8 million from Plaza Singapura compared with S$17.7 million for the period 2 August 2004 to 31 December 2004. Contribution from the four new properties, increased rental income from the other malls, and newly created retail spaces at Junction 8 which were completed in December 2004 also contributed to the improved NPI.

Assets

The total assets as at 31 December 2005 for CMT and its associate were S$3,483.6 million, compared with S$2,361.7 million as at 31 December 2004. The increase of S$1,121.9 million was mainly due to the acquisitions of Sembawang Shopping Centre, Hougang Plaza Units, Jurong Entertainment Centre and Bugis Junction, as well as an increase in property valuations for the other properties.