INTRODUCTION | INGENIOUS VALUE CREATION & GROWTH STRATEGIES | IN CONVERSATION | INSIGHTS INTO GROWTH | INSPIRING LEADERSHIP

INTEGRATING PEOPLE & SOCIETY | INVESTOR RELATIONS | IN REVIEW | INCREASING DOMINANCE | IN DETAILS

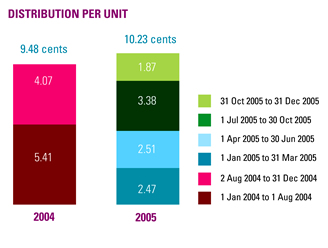

Distributions

For 2005, CMT made distributions of 10.23 cents which comprised 2.47 cents, 2.51 cents, 3.38 cents and 1.87 cents for the periods 1 January to 31 March 2005, 1 April 2005 to 30 June 2005, 1 July to 30 October 2005 and 31 October to 31 December 2005, respectively. In the financial year ended 31 December 2004, CMT distributed 5.41 cents per unit for the period from 1 January 2004 to 1 August 2004 and 4.07 cents per unit for the period from 2 August 2004 to 31 December 2004. Overall, the total distribution for the financial year ended 31 December 2005 of 10.23 cents per unit was an increase of 8.0 percent over the total distribution for the financial year ended 31 December 2004 of 9.48 cents per unit.

In line with our objective to deliver regular and consistent returns to Unitholders, CMT commenced distribution payments on a quarterly basis with effect from our first-quarter distribution in the financial year ended 31 December 2005. This allows Unitholders to receive distributions more regularly.

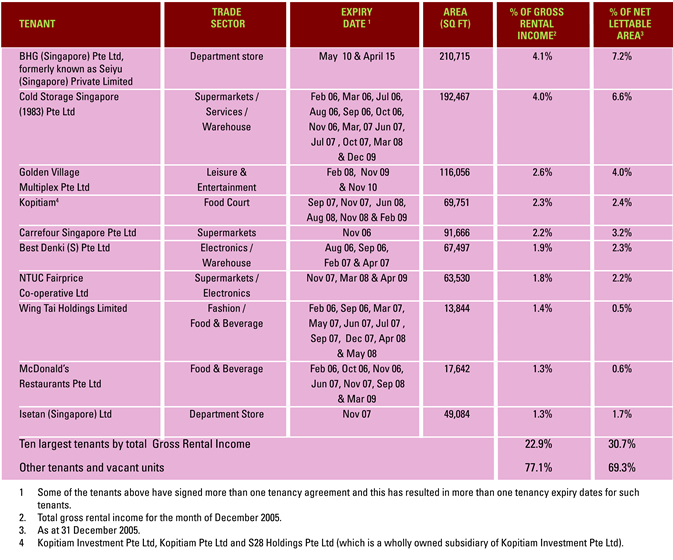

Top Ten Tenants

The gross rental income is distributed amongst the different tenants, with BHG (Singapore) Pte Ltd, formerly known as Seiyu (Singapore) Private Limited. making the highest contribution of 4.12 percent. The top ten tenants contributed 22.92 percent of the total gross income for CMT.

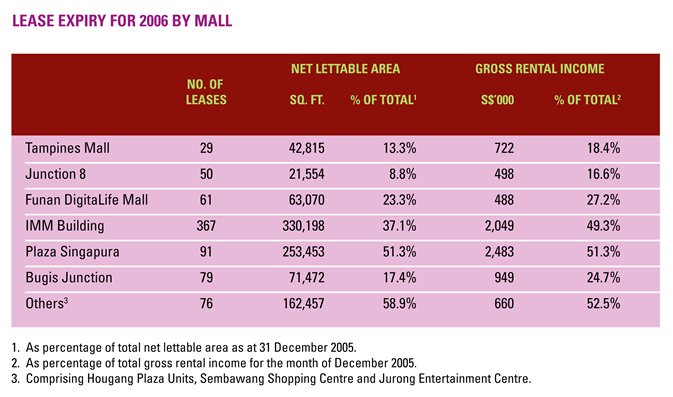

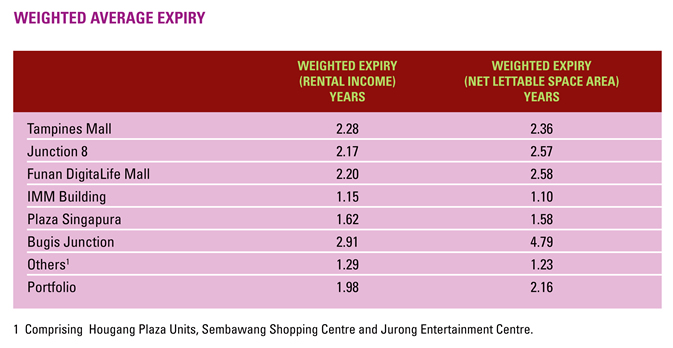

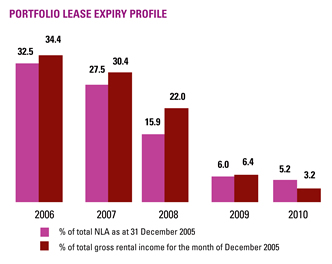

Lease Expiry Profile

The lease terms of our tenants are consistent with the market in Singapore, in that the lease term for specialty tenants is typically three years and for anchor tenants from five to seven years. The expiry profile of CMT’s portfolio of malls is well spread out with approximately 33 percent and 34 percent due to expire in 2006 and 2007, respectively based on Net Lettable Area (NLA). Based on the committed leases as at 31 December 2005, over 82.0 percent of the forecast total revenue1 for the financial year ended 31 December 2006 has been locked in.

- Based on the forecast, toegther with the accompanying assumptions, shown in the CMT Circular dated 18 Octoberr 2005.