INTRODUCTION | INGENIOUS VALUE CREATION & GROWTH STRATEGIES | IN CONVERSATION | INSIGHTS INTO GROWTH | INSPIRING LEADERSHIP

INTEGRATING PEOPLE & SOCIETY | INVESTOR RELATIONS | IN REVIEW | INCREASING DOMINANCE | IN DETAILS

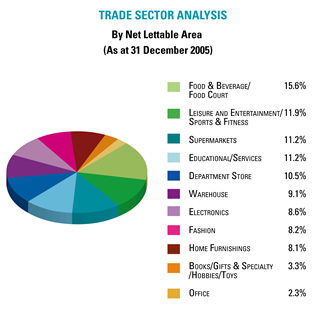

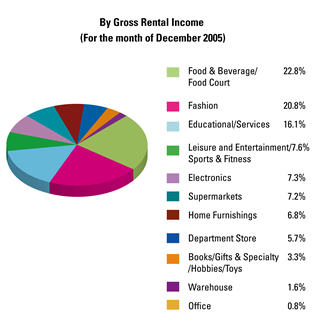

Trade Sector Analysis

The Manager’s active leasing efforts and retail management consciously aim to maintain a well-balanced trade mix in CMT’s malls that is not overly reliant on any one particular segment of the trade sector. Food & Beverage (F&B) outlets/food courts continue to be the main contributor to gross rental income as well as the largest user of space. The fashion trade is the second largest contributor to the gross rental income at 20.8 percent, while occupying only 8.2 percent of the NLA.

This is very much in line with market forces in Singapore where F&B and fashion continue to drive retail sales.

Increased Shopper Traffic

Both Tampines Mall and Junction 8 recorded in excess of 20 million shoppers in 2005. This was a record-breaking achievement for CMT as none of our malls have previously reached these numbers. We will continue to improve the trade mix, organise interesting events and enhance the shopping ambience to further increase the shopper traffic to our malls.

Advertising and Promotions

Many of our activities are organised across a number of the malls so as to achieve both synergy and cost efficiency.

At key festive periods such as Lunar New Year and Christmas, the malls use a single theme, and share promotional mechanics and communications. During the June and December school holidays, we arranged for popular cartoon characters such as Power Rangers, Wallace & Gromit, Thomas the Tank and Baby Looney Tunes to appear at the different malls. Premiums bearing their pictures were also produced as gift-with-purchases for our shoppers to take home for their children. In addition, during the Mid-Autumn Festival, Mooncake Fairs were held in IMM, Junction 8 and Tampines Mall with participation from over 30 hotels, restaurants, cake houses and confectioneries.

Activities for other special common occasions are targeted at the shoppers in individual malls. In May 2005, for example, we hosted different competitions in commemoration of Mother’s Day: ‘Most Beautiful Mum’ at Junction 8, ‘Most Beautiful Mum-to-be’ at Plaza Singapura, ‘Classic Mum’ at IMM, and ‘Mother-&-Child Lookalike’ at Tampines Mall. These pageants and contests drew more than 1,000 entries.

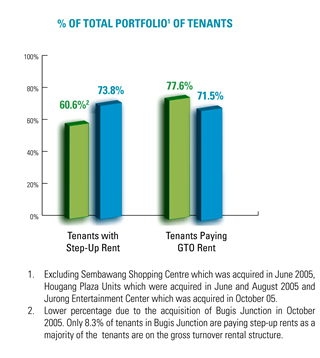

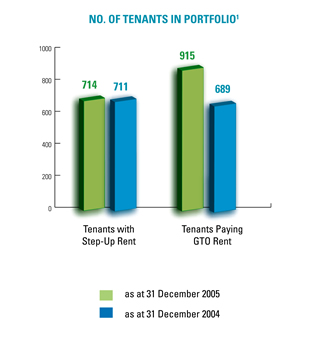

TENANTS WITH STEP-UP RENT AND GROSS TURNOVER RENT

Risk Management

Operational Risk

CMT and its associate have integrated risk management into the day-to-day activities in all functions. These include planning and control systems, operational guidelines, IT systems and operational, reporting and monitoring procedures involving the executive management committee and Board.

Investment Risk

One of the main sources of growth for CMT and its associate is the acquisition of properties. The risk involved in such investment activities is managed through a rigorous set of investment criteria which includes accretion yield, internal rate of return, growth potential and sustainability, location and specifications.

Interest Rate Risk

With the current global trend of rising interest rates, CMT and its associate proactively seek to minimise the level of interest rate risk by locking in most of our borrowings in fixed interest rates. As at 31 December 2005, CMT and its associate have locked in 97.4 percent of CMT’s borrowings at fixed rates and only the remaining 2.6 percent is at floating rates.

Foreign Exchange Risk

As the operations of CMT and its associate are currently based locally in Singapore, there is little or no foreign exchange exposure. CMT and its associate borrow in Singapore dollars from a special purpose vehicle, Silver Maple Investment Corporation Ltd (Silver Maple). Silver Maple issues foreign denominated notes and is able to obtain attractive spread by borrowing from the overseas markets.

Credit Risk

Credit risk is the potential earnings volatility caused by tenants’ inability and/or unwillingness to fulfil their contractual lease obligations. There is a stringent collection policy in place to ensure that credit risk is minimised, which is managed by the requirement of security deposits, usually in the form of cash or bankers’ guarantees of three months’ rent on average, and a vigilant monitoring system and procedures on debt collection.

Liquidity Risk

CMT and its associate actively monitor their cash flow position to ensure that there are sufficient liquid reserves in terms of cash and credit facilities to meet short-term obligations.

Deriative Financial Risk Instruma

CMT obtains funding through Silver Maple. There is little or no derivative financial instrument exposure level as the borrowings are secured via commercial mortgage-backed securitisation from Silver Maple.