CapitaRetail China Trust

CMT holds 122.7 million units in CapitaRetail China Trust (CRCT), which translates to an approximate 17.81% stake as at 31 December 2011. The fair value of CMT's investment in CRCT represents 1.54% of CMT and its subsidiaries' (CMT Group) total asset size as at 31 December 2011. Through its investment in CRCT, CMT's Unitholders are provided with an opportunity to enjoy the upside from China's growth potential without CMT's risk profile being significantly altered.

CRCT is the first and only China shopping mall REIT in Singapore, with a portfolio of nine income-producing shopping malls. Listed on the SGX-ST on 8 December 2006, it is established with the objective of investing in a diversified portfolio of income-producing real estate used primarily for retail purposes and located primarily in China, Hong Kong and Macau.

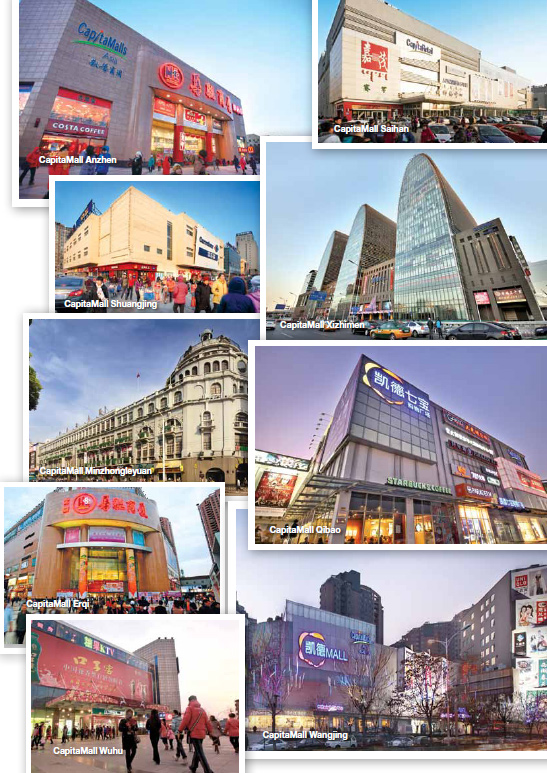

CRCT's geographically diversified portfolio of quality shopping malls is located in six cities in China. The malls are CapitaMall Xizhimen, CapitaMall Wangjing, CapitaMall Shuangjing and CapitaMall Anzhen in Beijing; CapitaMall Qibao in Shanghai; CapitaMall Erqi in Zhengzhou, Henan Province; CapitaMall Saihan in Huhhot, Inner Mongolia; CapitaMall Wuhu in Wuhu, Anhui Province; and CapitaMall Minzhongleyuan in Wuhan, Hubei Province. As at 31 December 2011, the total asset size of CRCT is approximately S$1.5 billion.

All the malls in the portfolio are positioned as one-stop family-oriented shopping, dining and entertainment destinations for the sizeable population catchment areas in which they are located, and are accessible via major transportation routes or access points. A significant portion of the properties' tenancies consists of major international and domestic retailers such as Wal-Mart, Carrefour and Beijing Hualian Group (BHG) under master leases or long-term leases, which provide CRCT's unitholders with stable and sustainable returns. The anchor tenants are complemented by popular specialty brands such as UNIQLO, ZARA, Vero Moda, Sephora, Watsons, KFC, Pizza Hut and BreadTalk.

CRCT has long-term growth potential from its right of first refusal arrangements to acquire assets held by CapitaMalls Asia–sponsored private funds, CapitaMalls China Income Fund, CapitaMalls China Development Fund II, CapitaMalls China Incubator Fund, as well as CapitaMalls Asia, one of the largest listed shopping mall developers, owners and managers in Asia.

CRCT delivered a strong set of results for the financial year 2011 (FY 2011). Gross revenue and net property income were RMB680.8 million (S$131.9 million) and RMB443.0 million (S$85.8 million), up 15.6% and 15.9% respectively from that for financial year 2010. Distribution per unit (DPU) in FY 2011 was 8.70 Singapore cents, an increase of 4.1% over the previous year. Across the portfolio, CRCT achieved strong rental reversion of 11.5% and operated at close to full occupancy rate of 98.1%. Tenant sales at CRCT's five multi-tenanted malls grew 26.1% compared to the previous year. CRCT's net asset value per unit as at 31 December 2011 grew 13.7% year-on-year to reach S$1.33 per unit.