Independent Retail Market Overview

Economic Growth

Singapore experienced an average real gross domestic product (GDP) growth rate of 5.9% per annum during the period between 2000 and 2011. This was despite the global financial crisis in 2008/2009, which saw real GDP growth decrease to 1.7% in 2008 and -1.0% in 2009. Singapore's economy was one of the first to recover from recession with an exceptional GDP growth of 14.8% in 2010, before settling back to an estimated 4.9% in 2011.

Looking forward, growth is expected to remain moderate over the next few years, with the Economist Intelligence Unit (EIU) forecasting GDP growth to ease further to 3.0% in 2012, before increasing to 4.4% in 2013 and 5.2% in 2014. This is in line with the expectations of Singapore's Ministry of Trade and Industry, which is forecasting GDP growth of between 1.0% and 3.0% in 2012.

It should be noted that there is considerable downside risk in Singapore's growth outlook due to continued uncertainty in the global economy. As highlighted in the World Bank's recent "Global Economic Prospects" report, persistent weakness in the Eurozone economies, and high levels of debt in the United States and Japan, mean that there remains a substantial risk of another global credit crunch. This could cause another global recession which would undoubtedly have a negative impact on Singapore's economy.

Inflation

Consumer price inflation in Singapore has been relatively low, averaging 1.9% per annum since 2000. However, 2011 proved to be an exception, with initial estimates showing an increase of 5.1% in consumer prices over the previous year, driven mainly by rising housing and food prices, as well as higher global oil prices. Looking forward, EIU expects slowing global economic activity to ease these inflationary pressures, causing consumer price inflation to slow to 2.9% in 2012, 2.1% in 2013 and 2.0% in 2014.

Retail price inflation, which measures the price increase of only retail goods and services, is typically slightly below consumer price inflation and averaged 1.0% per annum over the past decade. Initial estimates of retail price inflation for 2011 are at 1.5%, with lower price growth for many non-food goods partially offsetting the increase in food prices. Going forward, retail price inflation is expected to stay at just over 1.0% for the next three years.

Population

According to the Department of Statistics Singapore, the total population of Singapore in June 2011 was 5.2 million people. Of this population, 3.8 million are 'residents' (either citizens or permanent residents). The remaining 1.4 million, equivalent to 26.9% of the total population, are known as 'non-residents', and are mainly expatriate workers on long-term working visas. These workers include both skilled professionals and unskilled workers.

Over the next three years, we expect the total population of Singapore will grow at an average of 1.8% per annum, reaching 5.5 million in 2014. The growth in the resident population is expected to be relatively slow over this period, at around 1.4% per annum, reflecting a low birth rate. Growth in the non-resident population is expected to be higher, averaging 3.0% between 2012 and 2014. However, this is still lower than recent growth in the non-resident population, reflecting the slower economic growth outlook for Singapore and also a recent tightening of immigration policy.

Tourism

The tourism industry contributes considerably to the retail market in Singapore. We estimate that tourist spending accounted for approximately 17.6% of retail sales in 2011, a high proportion by international standards.

Singapore experienced a strong increase in tourist arrivals in 2011, continuing on the trend from 2010. According to the Singapore Tourism Board, tourist arrivals in 2011 increased by 13.1% from the preceding year. This strong growth was fuelled by the completion of several new tourist attractions in recent years, most notably the two integrated resorts which opened in 2010.

Going forward, tourist arrivals are expected to continue increasing, albeit at a slower rate, averaging 6.0% per annum over the next three years. This means that tourist spending will continue to increase as a proportion of the total market. We expect that by 2014, tourist spending will account for around 19.0% of total retail sales.

Retail Sales

Retail sales growth in Singapore has historically been quite strong, with nominal sales growth averaging 5.6% during the period between 2004 and 2011. This includes 2009, when a decline in consumer sentiment caused by the global financial crisis resulted in a contraction in retail sales by 1.7%. However, retail sales bounced back strongly with growth of 6.8% in 2010. Current estimates indicate nominal retail sales growth of around 6.1% for 2011.

Looking forward, we forecast retail sales growth to continue at 5.0%, 5.5% and 5.2% for 2012, 2013 and 2014 respectively.

Retail Supply

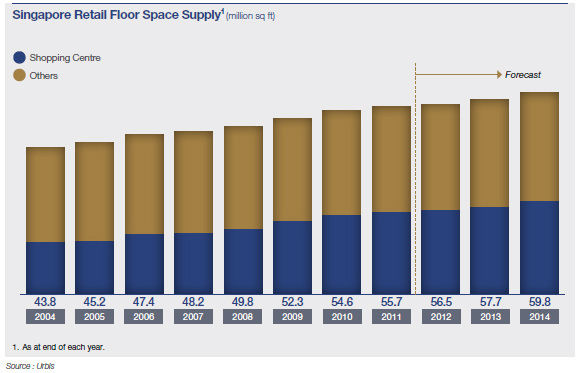

We estimate the total amount of retail floor space in Singapore in December 2011 was 55.7 million square feet (sq ft) of net lettable area (NLA). Around 43.6% of this space, equivalent to 24.3 million sq ft, is estimated to be in shopping centres.

A moderate amount of shopping centre floor space, totalling 870,000 sq ft, was added in 2011, a 3.6% increase in total shopping centre floor space supply. The smaller amount of new space is a contrast to 2009 and 2010, when 2.3 million sq ft and 2.0 million sq ft respectively were added to the market. The new shopping centre floor space completed in 2011 mainly comes from small projects, with the most significant being 112 Katong (207,000 sq ft) and Changi City Point (210,000 sq ft).

In the pipeline, there is a further 3.2 million sq ft of new shopping centre floor space expected to be completed over the 2012 - 2014 period. Significant suburban projects include two new shopping centres at Jurong East, the new integrated development at Bedok Town Centre and the Singapore Sports Hub. The most significant project on Orchard Road is the redevelopment of Hotel Phoenix which will have around 210,000 sq ft of retail and is expected to be completed in 2014.

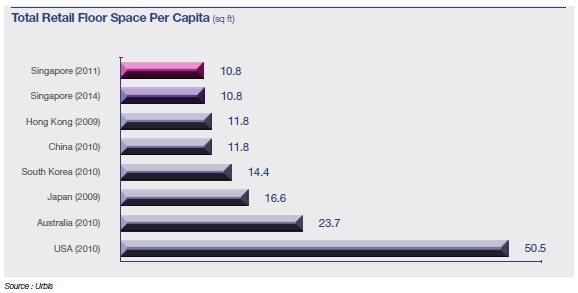

Retail Floor space per Capita

The total amount of retail floor space per capita in Singapore was estimated to be 10.8 sq ft in 2011 and is forecast to remain unchanged to 2014. At this level, Singapore retail floor space remains low compared to other developed Asian countries, such as Hong Kong, South Korea and Japan. This low per capita provision tends to deliver higher floor space productivity and better certainty for developers due to restricted levels of competition.

Major Mall Ownership

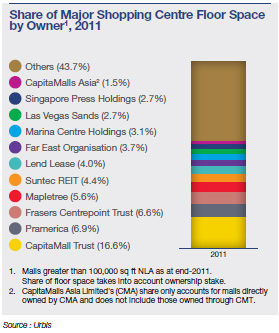

CapitaMall Trust (CMT) is the largest shopping centre owner

in Singapore, with a 16.6% share of the floor space of major shopping centres in Singapore (major shopping centres being those over 100,000 sq ft NLA). Due to the scale of operations, CMT has significant competitive advantages in terms of maintaining an extensive network of tenants and achieving economies of scale in centre management.

Retail Property Performance

2011 saw an improvement in the retail rental performance of both the Orchard Road and Suburban submarkets. This shows that the significant amount of new floor space added to the market in 2009 and 2010, particularly in the central area, is beginning to be absorbed by the market.

According to CB Richard Ellis (CBRE), average prime rents for Orchard Road in 4Q 2011 were S$31.60 per sq ft per month, an increase of 4.6% over the same period in 2010. Meanwhile, average prime rents for suburban centres were S$29.75 per sq ft per month, around 2.2% higher than 4Q 2010. It should be noted however that prime rents for both submarkets remained flat between 3Q 2011 and 4Q 2011, potentially signifying a softening of trading conditions in the final quarter.

Retail Rental & Occupancy Outlook

Continued growth in retail sales and a slower increase in new supply should underpin rental growth in the coming years. However, the growth in rental rates for the Suburban submarket is expected to be only moderate due to the addition of significant amount of new stock in 2013 and 2014.

We believe that rents on Orchard Road have reached the bottom of their decline, as shown by increases over the first three quarters of 2011. Going forward, retail sales growth, limited new supply and increasing demand from new retailers in the market should see rents continue to grow. Barring any worsening of economic performance, we expect rents on Orchard Road will increase by 2.0% in 2012 and 3.0% in 2013 and 2014.

For suburban malls, we expect to see rental growth of around 3.0% in 2012, before slowing to around 2.0% in 2013 and 2014 due to the significant amount of new supply expected in the submarket in these years.

We expect occupancy rates for retail properties to increase in line with rents. Occupancy in the Orchard Road submarket is expected to increase from around 94.5% in 2011 to 96.0% in 2014. Meanwhile, the average occupancy rate of suburban malls is expected to increase from 93.0% in 2011 to 93.5% in 2012, before decreasing by 1.0%-2.0% in 2013, once again due to the expected large increase in supply in this submarket.

Conclusions

Despite an expected softening in economic conditions for Singapore in 2012, the outlook for the retail property sector remains reasonably positive. The slowing in economic activity is expected to mainly affect the external sector, with continued domestic demand helping to keep retail sales growth positive. The positive outlook for tourist arrivals should also contribute to sustained growth in retail sales. Continued sales growth is expected to flow on to growth in rents and occupancy rates. However, there is considerable downside risk due to the uncertainty in the global economy. In the event of a repeat of the global credit crunch of 2008/09, the Singapore economy will be adversely affected and this will have a dampening effect on the retail property market. Nevertheless, as proven during the last recession, shopping centres which are well-positioned and proactively managed will tend to outperform the market, regardless of economic conditions.

Peter Holland

Director

Urbis

www.urbis.com.au

28 February 2012