Financial Review

Gross Revenue

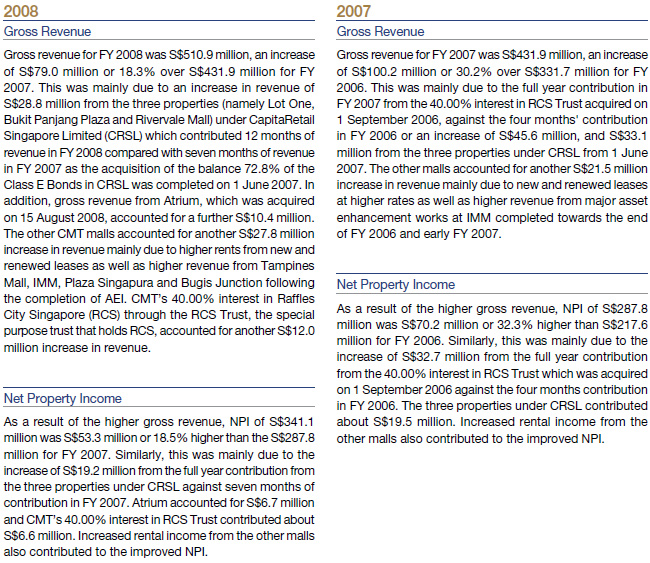

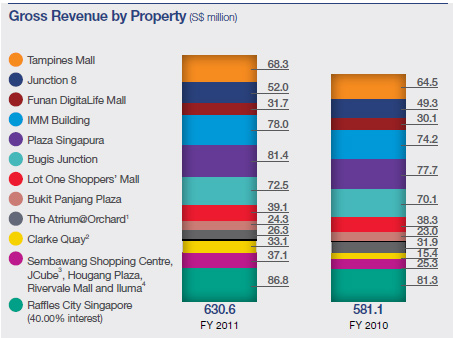

Gross revenue for the Financial Year (FY) ended 31 December 2011 was S$630.6 million, an increase of S$49.5 million or 8.5% over S$581.1 million for the FY ended 31 December 2010. Of the increase, S$28.9 million was due to Clarke Quay and Iluma, which were acquired on 1 July 2010 and 1 April 2011 respectively, while the balance was attributed to higher gross revenue across the malls mainly due to the higher rental rates achieved from new and renewed leases and step-up rents. The increase was partially offset by decrease in revenue from The Atrium@Orchard due to the commencement of its asset enhancement initiatives (AEI) in January 2011.

- The Atrium@Orchard has been undergoing AEI since January 2011.

- The acquisition of Clarke Quay was completed on 1 July 2010.

- JCube has ceased operations for asset enhancement works.

- The acquisition of Iluma was completed on 1 April 2011 and it has been undergoing AEI since November 2011.

N.M. Not Meaningful.

- The Atrium@Orchard has been undergoing AEI since January 2011.

- The acquisition of Clarke Quay was completed on 1 July 2010.

- JCube has ceased operations for asset enhancement works.

- The acquisition of Iluma was completed on 1 April 2011 and it has been undergoing AEI since November 2011.

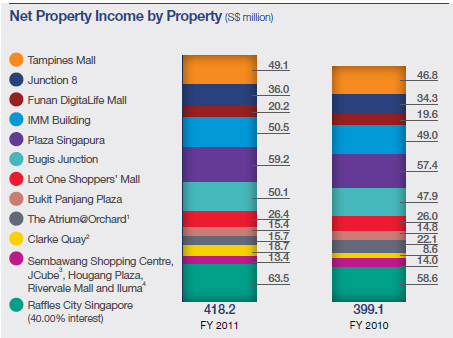

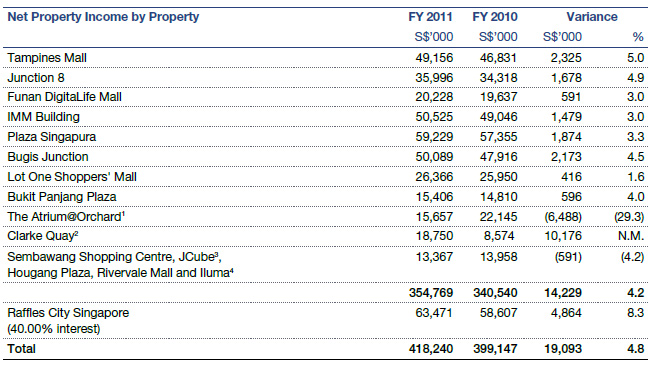

Net Property Income

As a result of the higher gross revenue, Net Property Income (NPI) of S$418.2 million was S$19.1 million or 4.8% higher than the S$399.1 million for FY 2010. Similarly, this was mainly due to Clarke Quay and Iluma which were acquired on 1 July 2010 and 1 April 2011 respectively and higher rental income across the malls which is partially offset by decrease in revenue from The Atrium@Orchard and JCube due to AEI.

- The Atrium@Orchard has been undergoing AEI since January 2011.

- The acquisition of Clarke Quay was completed on 1 July 2010.

- JCube has ceased operations for asset enhancement works.

- The acquisition of Iluma was completed on 1 April 2011 and it has been undergoing AEI since November 2011.

N.M. Not Meaningful.

- The Atrium@Orchard has been undergoing AEI since January 2011.

- The acquisition of Clarke Quay was completed on 1 July 2010.

- JCube has ceased operations for asset enhancement works.

- The acquisition of Iluma was completed on 1 April 2011 and it has been undergoing AEI since November 2011.

Distributions

CMT achieved unitholders' distribution of S$301.6 million for FY 2011, an increase of S$6.8 million or 2.3% as compared to FY 2010. Distribution per unit (DPU) for FY 2011 is 9.37 cents, 1.4% higher than 9.24 cents for FY 2010. The increase was mainly attributed to the strong operating performance from the properties under the portfolio and the release of S$8.8 million of net tax-exempt and capital distribution income (after interest expense and other borrowing costs) from CapitaRetail China Trust (CRCT) retained in FY 2010. CMT has also retained S$5.1 million capital distribution income received from CRCT for future distribution. For FY 2011, CMT distributed 100.0% of its taxable income.

On 10 November 2011, 139,665,000 new units in CMT (Units) were issued via a private placement exercise for the purposes of financing capital expenditure, AEI and general and corporate working capital. In order to ensure fairness to holders of CMT units prior to the issuance of the private placement new units, CMT declared an advanced distribution for the period from 1 October 2011 to 9 November 2011, the day immediately prior to the date on which the private placement new units were issued. The advanced distribution was paid on 6 January 2012.

Breakdown of the unitholders' distribution for FY 2011 with FY 2010 comparatives are as follows:

- DPU for the period from 10 November 2011 to 31 December 2011 is based on the enlarged number of 3,328,416,755 Units as at 31 December 2011 after the issuance of 139,665,000 Units via the private placement exercise on 10 November 2011.

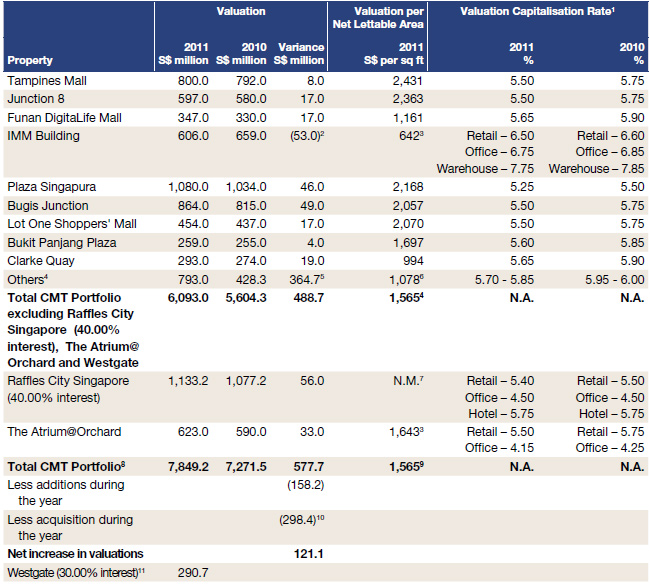

Assets

As at 31 December 2011, the total assets for CMT and its subsidiaries (CMT Group) were S$9,172.2 million, compared with S$8,125.9 million as at 31 December 2010. The increase of S$1,046.3 million was mainly due to the acquisition of Iluma for a purchase consideration of S$295.0 million on 1 April 2011, revaluation surplus of S$121.1 million, capital expenditure of S$158.2 million, investment in the development of Westgate (CMT's 30.00% share in Infinity Mall Trust and Infinity Office Trust) of S$306.6 million and increase in cash and cash equivalents of S$44.7 million.

Valuations And Valuation Capitalisation Rates

as at 31 December

N.A. Not Applicable.

- Valuation capitalisation rate refers to the capitalisation rate adopted by the independent valuers to derive the market values of each property.

- Decline in valuation mainly due to the planned repositioning exercise of IMM Building into a value-focused mall.

- Reflects valuation of the property in its entirety

- Comprising Hougang Plaza, JCube, Sembawang Shopping Centre, Rivervale Mall and Iluma which was acquired on 1 April 2011.

- Includes the declines in valuation of Sembawang Shopping Centre and Hougang Plaza which are mainly due to more cautious outlook for market rentals achievable in view of bulk renewals in 2012.

- Valuation per sq ft excludes JCube which has ceased operations for asset enhancement works.

- Not meaningful because Raffles City Singapore comprises retail units, office units, hotels and convention centre.

- Total valuation excludes Westgate which is currently under development.

- Valuation per sq ft excludes JCube and Raffles City Singapore.

- This relates to the acquisition of Iluma on 1 April 2011 for a purchase consideration of S$295.0 million, which is based on an independent valuation dated 21 February 2011 and includes acquisition fees and other related costs.

- Valuation of the land as at 1 November 2011.

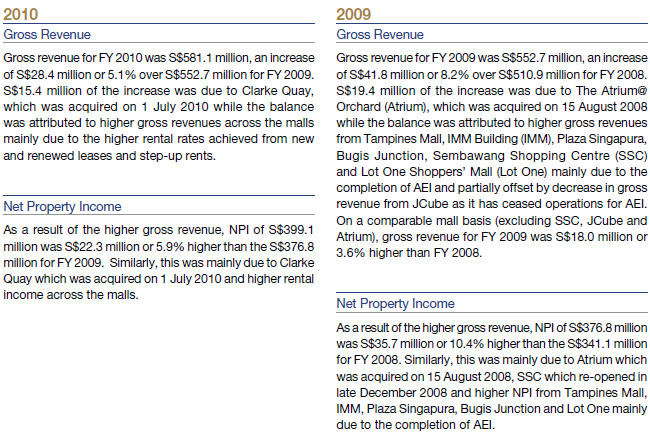

Financial Performance for 2007 to 2010