Growth Strategies

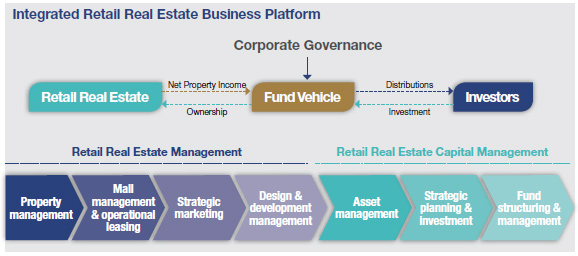

Integrated Retail Real Estate Platform

We are able to tap on CapitaMalls Asia's unique integrated retail real estate platform, combining the best of retail real estate management and capital management capabilities. Through this platform, we can call upon a professional and experienced team of operations, project and asset managers who work closely and seamlessly with each other to:

- Formulate medium- and long-term strategies and initiatives to deliver sustainable returns

- Enhance shopping experiences to attract and increase shopper traffic

- Review space usage to optimise space productivity and income

- Manage lease renewals and new leases diligently to minimise rental voids

- Manage and monitor rental arrears to minimise bad debts

- Manage projects to ensure timely completion within budgets

- Manage and monitor property expenses to maximise net property income

- Address all key operational issues to ensure alignment with the Manager's strategies

Intrinsic Organic Growth

Active management of new leases and lease renewals is important for us to capture opportunities for organic growth. A major component of CMT's organic growth has been achieved through:

- Step-up rent

- Gross turnover (GTO) rent, which makes up about 3.0% to 5.0% of CMT's gross revenue. This is a useful management tool which aligns CMT's interests with those of our tenants. Most of the leases at CMT's properties follow a rental structure which encompasses step-up rent plus a small component of GTO rent or a larger component of GTO rent only, whichever is higher

- Non-rental income from car parks, atrium spaces, advertisement panel spaces, casual leasing, vending machines and customer service counters

- Improved rental rates for lease renewals and new leases

Innovative Asset Enhancement Initiatives

Creative asset planning unlocks the potential value of CMT's properties to further propel growth by enhancing the retail environment and improving the attractiveness of the properties to shoppers and retailers. Diverse ways to increase the yield and productivity of CMT's retail spaces include:

- Decantation whereby lower-yield spaces are converted into higher-yield spaces

- Reconfiguration of retail units to optimise space efficiency

- Maximising the use of common areas, such as bridge space, and converting mechanical and electrical areas into leasable space

- Upgrading amenities, adding play and rest areas, providing design advisory on shop front design and creating better shopper circulation to enhance the attractiveness of our malls

Inviting Experiences

To stay ahead of consumer trends, we constantly reinvent retail experiences with innovative shopping, dining and leisure combinations which help to maximise the sales of the tenants and generate growth through improved rental income. The increase in shopper traffic is generated through:

- Alignment of tenancy mix with current market trends which ensures a continuous good mix of attractive and popular retail outlets in CMT's properties

- New retail concepts which generate fresh excitement and positive sales

- Enhancing shoppers' experiences with a more pleasant, comfortable and exciting environment by improving connectivity between floors, installing electronic car park guidance systems, upgrading restroom facilities, baby nursing rooms, family room, children playgrounds, designated water play area with interactive features for children and alfresco dining areas

- Innovative marketing and promotional events to draw in the crowds

- Attractive shop fronts and visual merchandising design ideas

Instrumental Investments

The ability to identify value-adding acquisitions, investments and greenfield development projects to add to the portfolio and further enhance their value is central to CMT's long-term sustainable growth.

Our investments must satisfy the investment criteria of:

- potential for growth in yield,

- rental sustainability and

- potential for value creation.

CMT's 17.81% interest in CapitaRetail China Trust (CRCT) provides some exposure to the tremendous growth in the China retail real estate market without significantly changing the asset profile of CMT.

In May 2011, CMT took a 30.00% stake in a joint venture to develop a prime site at Jurong Gateway, marking its first foray into greenfield developments. The new retail-cum-office development, to be called Westgate, will offer CMT a new avenue of growth.

Intensive Capital & Risk Management

We seek to optimise returns to Unitholders while maintaining a strong capital base and credit rating to support CMT's growth.

Regular assessments of capital management policies are undertaken to ensure that they are adaptable to changes in economic conditions and the risk characteristics of CMT. We also monitor our exposures to various risk elements by closely adhering to well-established management policies and procedures.

As part of our proactive capital management, we have diversified our sources of funding and reduced the lumpiness of debts maturing in any one year.

CapitaMall Trust Report to UnitHolders 2011