|

• Step-up rentals

As at 31 December 2003, a total of 45.4 percent

or 437 tenants are on the step-up rental structure. The yearly

rental increments which have been built into these leases

will serve to provide intrinsic annual rental increases of

2 to 4 percent.

• Improved rental rates

Rental rates for the new leases concluded in 2003

reflect a 6.2 percent increase from the forecast rentals.

With the improved rental rates in place and step-up rentals

providing intrinsic growth, CMT has established a platform

for growth in future years.

- Forecast rent for the period from 1 January to 25 June

2003 is based on the assumptions in the CMT offering circular

dated 28 June 2002 and the forecast rent for the period

from 26 June to 31 December 2003 is based on the assumptions

in the CMT circular dated 11 June 2003.

- IMM Building was acquired on 26 June

2003. Forecast rent for the period from 26 June to 31 December

2003 is based on the assumptions in the CMT circular dated

11 June 2003.

• Asset enhancements

Apart from the intrinsic growth brought about

by the step-up leases, CMT has further demonstrated that deliberate

asset planning can enhance the value of net lettable area

(NLA) at the malls to further propel growth. Through innovative

asset planning, higher yielding retail spaces were created

within the Gross Floor Area (GFA) constraint.

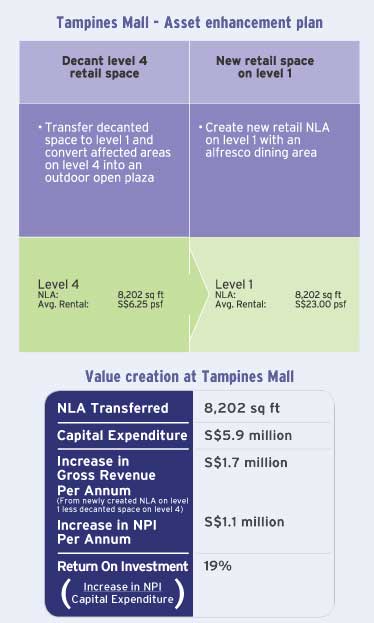

Tampines Mall

8,202 square feet of retail areas on level 4 were decanted (removed),

and transferred to the ground level to create new shops and food

& beverage outlets with an alfresco dining area. The new retail

areas command better rental values of more than three times the

average rental rates at the foregoing space on level 4. All new

tenants have commenced trading since December 2003.

An approximate S$5.9 million was spent on this

and the Manager expects an increase of S$1.1 million in Net

Property Income (NPI) per year.

Before - Uncovered walkway |

|

After - Covered walkway with an alfresco dining area |

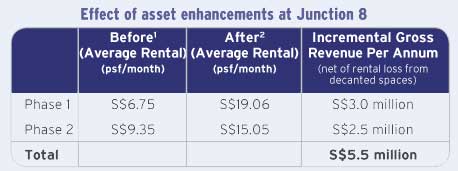

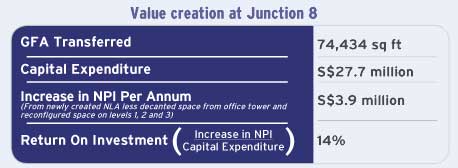

Junction 8

Earlier in the year, a 36 percent improvement in rental rates was

achieved for the area once occupied by SAFE Superstore. Without

losing the electrical and home appliances element, the space on

level 4 was split into smaller units to accommodate a wider variety

of tenants at higher rental rates.

Besides this, approximately 75,000 square feet

of office space GFA, generating an average rent of S$3.50

per square foot per month, will be decanted and transferred

to the lower levels of basement 1, and levels 1 and 2 as retail

space. The new retail areas will command more than three times

the average rental rates paid by office tenants previously.

Phase 1 of the above asset enhancement works has

been completed with higher yielding retail space created in

basement 1. This includes food kiosks which neatly complement

the supermarket and food outlets in operation on that level.

All new tenants on basement 1 have commenced operations since

December 2003.

Under Phase 2, more retail NLA will be created

on levels 1 and 2 of the mall. This is currently in progress

and is expected to be completed by end 2004.

An approximate S$27.7 million will be spent on

these works and the Manager expects an estimated increase

of S$3.9 million in net property income per year upon completion.

- GFA to be decanted or reconfigured from the office tower

and levels 1, 2 and 3 of the retail podium as at 31 December

2003.

- Newly configured or created net lettable area on basement

1, and levels 1 and 2 after the completion of asset enhancement

works scheduled for completion by end 2004.

Note: Based on Manager’s estimate

Before - Basement 1 carpark space...... |

|

... converted to food kiosks. |

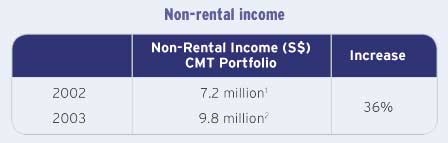

• Non-rental income or "other income"

| This has been a major component of CMT’s

growth. For the financial year 2003, non-rental income

contributed 8.4 percent to gross revenue. This includes

income from carparks, vending machines, casual leasing,

services provided at customer service counters, advertisement

panel spaces, etc. CMT will continue to explore new avenues

for growth in this area. We believe there is room to further

develop this revenue component. |

Vending machines and pillar wraps -

a major component of non-rental income. |

- Excludes non-rental income from IMM.

- Includes non-rental income from IMM, which was acquired

on 26 June 2003.

|