|

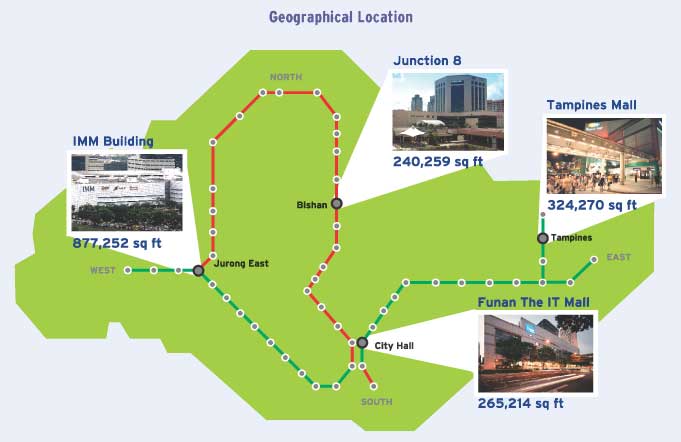

The CMT portfolio comprises Tampines

Mall, Junction 8, Funan The IT Mall and IMM Building totalling

1,706,995 square feet of NLA as at 31 December 2003. The portfolios

income stream is well supported by a large and diverse pool

of more than 900 committed leases with gross rental income

of S$107 million for the year ended 31 December 2003.

The locality of the four malls capitalises

on the traffic flow from the MRT stations which are located

either beside or near to the malls. With IMM in the west of

Singapore, Junction 8 in the north, Tampines Mall in the east

and Funan in the city area, CMT is poised to capture most

regional segments of the Singapore population.

|

The 3-year lease terms for retail

tenants, which is consistent with the general practice

in the Singapore property market, exposes CMT to certain

risks as a result of the significant rates of lease

expiries each year. With a pro-active leasing strategy,

these risks can be mitigated. As at 31 January 2004,

26 percent of leases due for renewal in 2004 have been

renewed. This places CMT in a good position to meet

expectations. Moreover, with prime suburban locations

in high demand and limited competition, CMT is well

positioned to capitalise on these factors for its future

growth. |

|

|

Gross Rental Income is also well distributed

amongst the different tenants, with Cold Storage (Singapore)(1983)

Pte Ltd making the highest contribution of 4.2 percent. Additionally,

the top 10 tenants which occupy 27.5 percent of the total

NLA, contribute 21.6 percent of Gross Rental Income to the

portfolio.

|

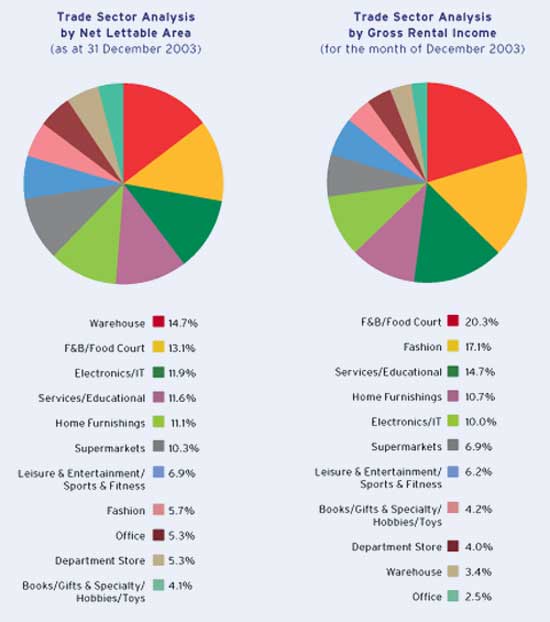

- For the month of December 2003.

- As at 31 December 2003.

|

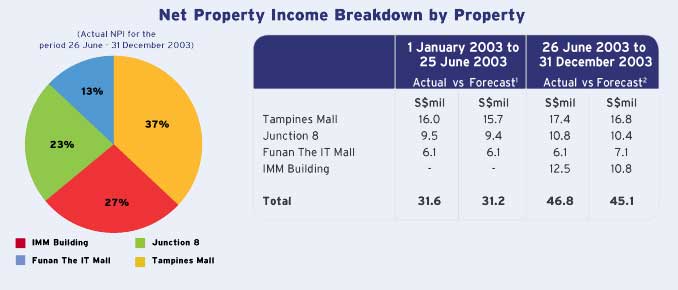

With the addition of IMM, income contribution

from the malls is generally well balanced, with Tampines Mall

contributing the largest share of 37 percent of the portfolio

NPI, for the period 26 June to 31 December 2003. The even

distribution of income sources produces a more stable and

secured portfolio.

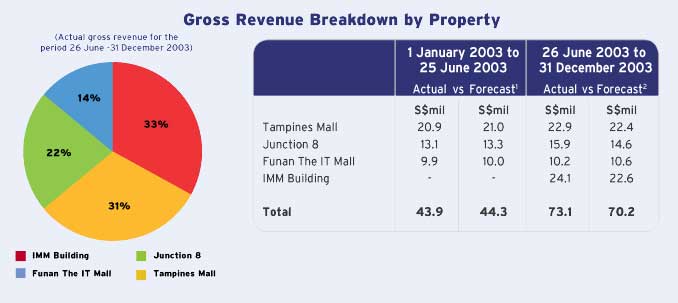

All properties have contributed positively

to the bottom line. With the exception of Funan, all properties

have exceeded forecasts relating to NPI and gross revenue.

For Funan, the slight decline was due to an increase in vacancy

voids arising from asset enhancements and an increase in fitting

out expenses, in a deliberate attempt on the Managers part

to ensure Funan is positioned for long term sustainability.

- Based on the forecast, together with

the accompanying assumptions, in the CMT circular dated

11 June 2003 for all the properties (excluding IMM Building)

for 2003 excluding the forecast for the period from June

to December 2003 but including the pro-rated forecast for

the first 25 days of the June to December 2003 period.

- Based on the forecast, together with

the accompanying assumptions, in the CMT circular dated

11 June 2003 for all the properties for the period from

June to December 2003 pro-rated for the period from 26 June

to 31 December 2003.

- Based on the forecast, together with

the accompanying assumptions, in the CMT circular dated

11 June 2003 for all the properties (excluding IMM Building)

for 2003 excluding the forecast for the period from June

to December 2003 but including the pro-rated forecast for

the first 25 days of the June to December 2003 period.

- Based on the forecast, together with

the accompanying assumptions, in the CMT circular dated

11 June 2003 for all the properties for the period from

June to December 2003 pro-rated for the period from 26 June

to 31 December 2003.

A good spread in the trade mix ensures that

CMT is not overly reliant on any one particular segment of

the retail sector. At present, food & beverage outlets

are the top contributors to the total gross rental income,

contributing 20 percent to the total gross rental income and

accounting for 13 percent of the total NLA. This ensures that

risks are well spread across all retail segments.

|