|

YIELD-ACCRETIVE ACQUISITION AND INVESTMENTS

2003 saw our very first yield-accretive

acquisition of IMM Building (IMM) at a cost of S$264.5

million and the yield-accretive investment of S$58.0

million in the Class E Bonds issued by CapitaRetail

Singapore Limited (CRS), a special purpose vehicle which

owns Lot One Shoppers’ Mall, Bukit Panjang Plaza and

Rivervale Mall. Two separate capital raising exercises

were held to fund these investments. On both occasions,

the response was overwhelming with all units fully subscribed.

The overall success of our equity offerings was a clear

mandate from the public and unitholders of their confidence

in CMT despite the then prevailing subdued economic

sentiments and is testament that CMT has established

a strong performance track record. The management is

indeed heartened by the show of support.

INCREASED LIQUIDITY AND MARKET CAPITALISATION

With 164.8 million new units issued

in 2003, CMT enjoyed improved liquidity and a remarkable

increase in market capitalisation. This paved the way

for CMT’s inclusion in various prestigious investment

indices which are widely referred to by international

fund managers as performance benchmarks in the selection

and monitoring of investments. These include Global

Property Research’s GPR 250 Index and GPR General Index,

as well as the EPRA/NAREIT Global Real Estate Index

and its sub-indices.

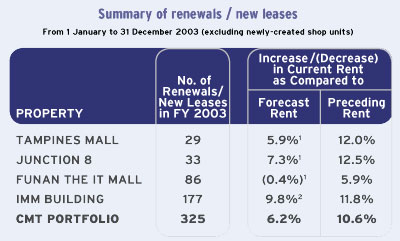

- Based on the forecast,

together with the accompanying assumptions,

in the CMT circular dated 11 June 2003 for all

the properties for the period from June to December

2003 pro-rated for the period from 26 June to

31 December 2003.

- Drop due to increase in

vacancy voids because of asset enhancements,

and increase in fitting out expenses.

|

| |

- Forecast rent for the

period from 1 January to 25 June 2003 is based

on the assumptions in the CMT offering circular

dated 28 June 2002 and the forecast rent for

the period from 26 June to 31 December 2003

is based on the assumptions in the CMT circular

dated 11 June 2003.

- IMM Building was acquired

on 26 June 2003. Forecast rent for the period

from 26 June to 31 December 2003 is based on

the assumptions in the CMT circular dated 11

June 2003.

|

UPFRONT LAND PREMIUM PAYMENT FOR

IMM In another noteworthy development,

Jurong Town Corporation (JTC) has granted the approval

for CMT to convert its holding of IMM (presently under

an annual rent revision scheme) to an upfront premium

scheme for a lease term of 45 years to January 2049

upon the payment of an upfront land premium of S$55.7

million. This has favourable implications for unitholders,

as potential increases in the annual land rent can be

averted under this arrangement.

PROACTIVE MANAGEMENT Apart

from growth through investments, our on-going proactive

approach to managing the malls provided the foundation

for CMT’s remarkable performance in 2003. CMT achieved

close to 100 percent retail occupancy and an improvement

of 3.7 percent in total net property income (refer to

chart “Net Property Income” on pg 6) across the four

malls. With the exception of

Funan The IT Mall (Funan), the malls exceeded our forecast

Net Property Income (NPI) and renewal rental rates.

Considering that Junction 8, Tampines Mall and IMM were

on track for better than expected results for the year,

a deliberate attempt on our part was made to reposition

Funan. As a result, there was an increase in vacancy

voids due to asset enhancements carried out and an increase

in fitting out expenses to establish the platform for

Funan’s growth in the future. On

a portfolio basis, the new leases concluded for the

year saw a 6.2 percent increase in rental rates (refer

to “Summary of Renewals / New Leases” on this page)

versus forecast rental rates.

ASSET ENHANCEMENTS Rental

improvements aside, we believe there is always room

to further propel growth at the malls. This was achieved

through a disciplined and proactive approach to asset

planning and management of the properties. Every investment

decision was calculated and premeditated in meticulous

detail at each stage of the planning process. An innovative

thought process was also necessary to jump-start the

asset enhancement initiatives. In fact, during the year,

Phase 1 of the asset enhancements at Junction 8 and

Tampines Mall were completed and all new tenants commenced

trading ahead of schedule. CMT will continue to break

new ground in creating increased value through asset

enhancements, hence enhancing returns for CMT’s unitholders.

Going forward, CMT will continue with asset enhancement

initiatives at the malls. Phase 2 of the asset enhancements

at Tampines Mall and Junction 8 are currently underway

and we expect completion by end 2004. Over at Funan,

we expect to see more brand-name retailers in the coming

years. Asset enhancements have also commenced and this

will give Funan a totally new and refreshing facade

with escalators providing direct access from the ground

level to the upper levels. With

in-principle approval granted by the Urban Redevelopment

Authority (URA), we are also looking forward to asset

enhancement works at IMM, which will spur growth in

the years ahead. Work is expected to commence in early

2005. With business conditions

expected to improve in 2004, consumer sentiment is poised

to be increasingly positive. In the same light, we expect

that retail sales will remain upbeat, especially for

retailers focusing on basic and essential consumer goods.

We are optimistic for a pick up in retail activities,

barring any unforeseen circumstances. As

always, we strive to increase value for all our stakeholders.

CMT will continue to explore new ground and innovate

so as to stay relevant to changing market demands and

economic conditions and thus continue to sustain its

growth. Our main objectives

for the year 2004 will be to maintain the existing high

occupancy rates and achieve our targeted earnings for

the year. CMT looks forward to another strong showing

in 2004.

With

the transparent nature of the Real Estate Investment

Trust structure, it is imperative that CMT makes timely

and accurate disclosure of material information. Good

corporate governance remains high on our agenda.

Finally,

we would like to thank our unitholders, business partners,

customers including both tenants and shoppers, and all

staff members for their support in these challenging

times. With the continued support of all stakeholders,

CMT will continue to engineer growth through value creation

and endeavour to deliver on forecast DPU.

18 March 2004

- Derived from market price per

unit of S$1.43 as at 31 December 2003, over the market

price of S$1.01 as at 31 December 2002.

- Derived from 2003 full-year DPU

over 2003’s weighted average market price per unit

of S$1.17.

|